Study Says Cash is a Public Good to be Safeguarded

A study from Germany’s University of Rostock characterises cash as ‘a public good’ and presents an argument for why there is no substitute for banknotes and coins as an important economic balance, and they need to be safeguarded now more than ever.

The authors refer to a recent ‘hostility to cash’, meaning the trend of incentivisation to use privately-managed digital payment systems, driven by banking and financial sectors and supported by governments. While the COVID-19 pandemic has boosted this movement—despite concerns around the safety of handling cash being swiftly debunked by the WHO and central banks—it has also led people to carry and hold more cash, demonstrating the continued essentiality of physical money, most especially in times of economic hardship.

Cash is—even more, in troubled economic times—not otherwise substitutable, but rather a welfare-enhancing public good to be safeguarded.

The paper applies a logical-analytical approach to recently-published research and the latest statistical data to illustrate that ‘cash has been unjustifiably accused of facilitating illicit transactions’ and the pandemic has been ‘(mis)used to push economic subjects away from banknotes and coins.

The authors observe ‘banknotes and coins are a public utility, which cannot be used by private actors of banking and financial sectors to earn profits,’ and that ‘from a mere entrepreneurial perspective, it is understandable that private financial actors—among others, commercial banks—are interested in pushing consumers towards private digital money.’ They further note that, in order to facilitate a smooth transition to digital payments, ‘individuals should be convinced that they are “choosing” (i.e. “preferring”) digital payments.’ Once the process of adaptation begins, they say, ‘compliance becomes the most likely outcome.’

Cash remains an inclusive, privacy-preserving, public means of settlement while digital payments further privatise the banking and financial system gentrifying payments.

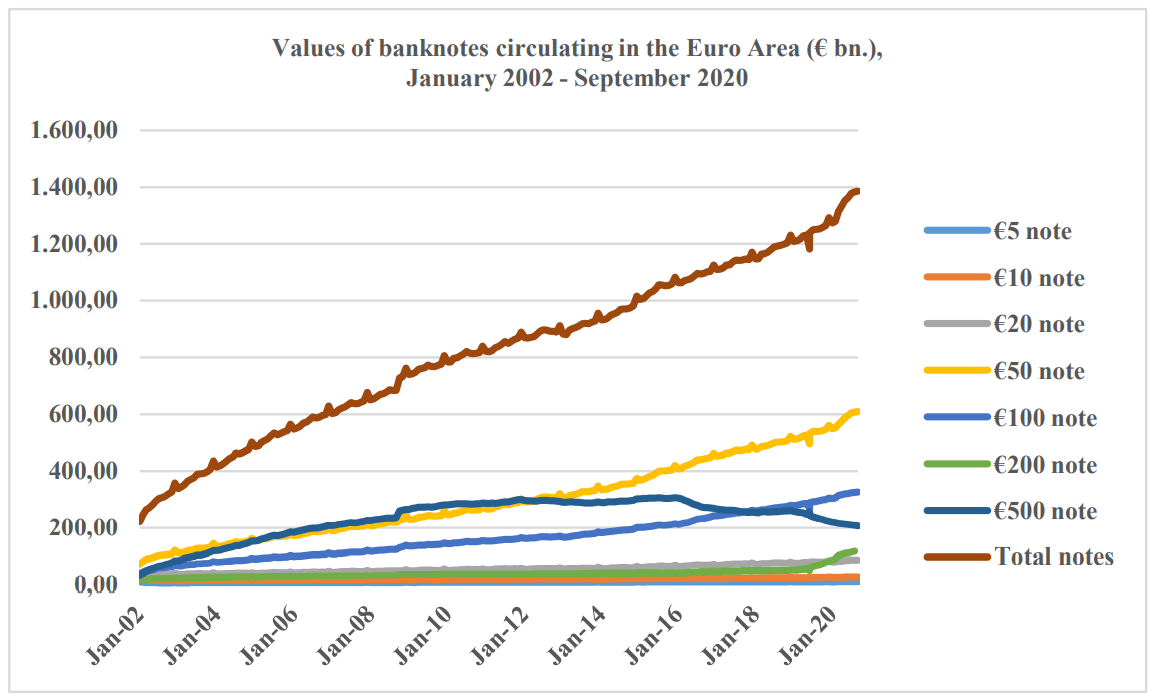

Despite the incentivisation of non-cash payments, the total value of banknotes circulating in the Euro Area is still rising at a significant rate. This is a pattern commonly seen around the world in the aftermath of disasters, and in times of economic instability, as people turn to the certainty offered by holding physical cash. Its tangibility, and usability offline and without electricity, make it unique in the payments landscape. As the pandemic destabilises both economies and people’s personal circumstances, cash continues to provide a haven of trust and certainty.

Source: Institutional Hostility to Cash and COVID-19, based on European Central Bank data

The authors conclude that, alongside intensifying issues around financial inclusion, accelerating the digitalisation of payments and advancing cash-free commerce ‘is likely to obliterate people’s privacy and also entrench racial and gender discrimination.’ As stores of value, whose economic role is even more relevant in times of crisis, banknotes and coins are ‘not easily replaceable in gold-detached systems whose “anchor of stability” is (physical) cash.’

Any attempt to restrict or eliminate cash, namely a (monetary) public good issued by central banks, results in welfare losses due to the increased monopoly power of the (private) banking and financial sector.