Exploring Consumer Payments During the Pandemic

The U.S. Federal Reserve has published a second collection of findings from its 2020 Diary of Consumer Payment Choice survey, noting the share of respondents making in-person payments was up 26 percent and cash holdings have increased to an average of $530 per household.

In partnership with the Federal Reserve Banks of Atlanta and Boston, the Federal Reserve’s Cash Product Office conducts annual Diary of Consumer Payment Choice surveys each October. These provide valuable insights into how payment practices and preferences evolve over time, and given the ‘extraordinary disruption’ to payments presented by COVID-19 from early 2020, a supplemental survey was produced to assess the payments landscape in April 2020. At that time, only one-third of consumers reported making any in-person payments, compared with 96 percent in October 2019.

To provide a more up-to-date picture of the ongoing impact of the pandemic, a second supplemental survey was conducted in August. This time, 60 percent of respondents said they had made in-person payments while 40 percent reported switching to online or phone payments for transactions previously conducted in-person.

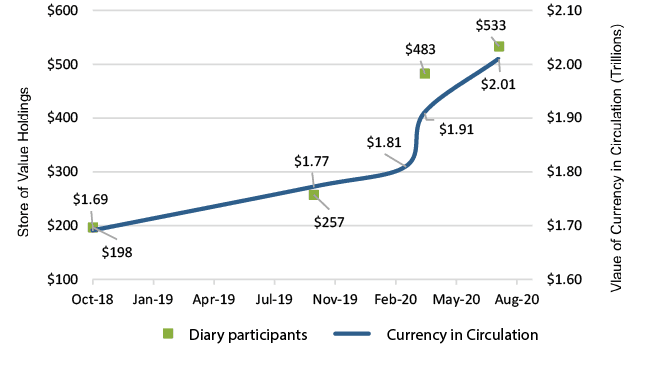

The survey also noted cash holdings had risen considerably during the pandemic. In October 2019, the average store of value cash holdings was approximately $250. This rose to $483 in April 2020 and $533 by August of that year. The following figure illustrates how cash holdings correlate with overall cash in circulation.

Source: Federal Reserve Bank of San Francisco

Meanwhile, people’s cash carrying habits have returned to pre-pandemic levels. Compared to October 2019, the April 2020 survey found the average value of cash held was up 16 percent to $81. The average value reported in August was back to 2019’s figure of $70. When weighed against the increase in the value of cash stored, the authors conclude that consumers had less incentive to carry and use their extra cash during the pandemic, and had thus shifted towards using cash as a store of value rather than a payment method.

While some respondents shifted in-person shopping to online or over the phone, 77 percent of respondents who made in-person purchases were [not] avoiding or averse to using cash. This, along with the increase in CIC, shows people still rely on cash, especially during uncertain times.

The authors note that the pandemic’s disruption of the normal flow of cash through the economy ‘speaks to the importance of a flexible and resilient cash supply chain.’ They also observe that how long the pandemic will last, how severe its economic impact will be, and whether consumers will continue to value cash as a payment option are ‘persistent unknowns.’

The next findings from the 2020 Diary of Consumer Payments Choice are planned for publication in Spring 2021.