ECB Dispels Concerns Around COVID-19 and Cash

A recent European Central Bank (ECB) paper seeks to ‘dispel concerns about contracting the SARS-CoV-2 virus from cash transactions’, presenting scientific evidence supporting the safety of banknotes and coins. It also assesses how the pandemic has affected demand for euro cash.

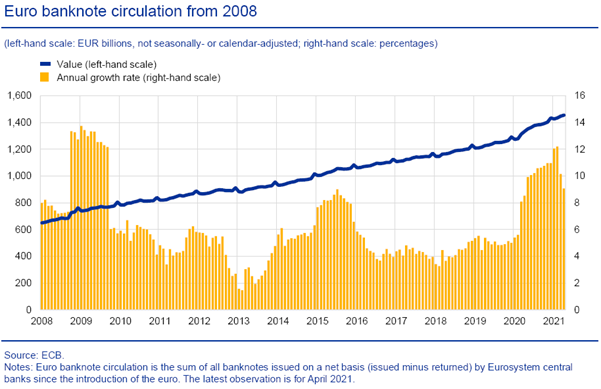

The paper—Catch me (if you can): assessing the risk of SARS-CoV-2 transmission via euro cash—opens with the observation that demand for cash as a store of value has risen significantly while the use of cash in transactions has fallen. It notes citizens reported using less cash partly due to fear of infection—‘fears that were stoked by statements in the media and from public authorities’—despite research confirming the risk of viral transmission via banknotes and coins is very low.

Reinforcing advice from the Bank of England and the U.S. Centers for Disease Control and Prevention, the ECB paper states ‘cash is safe to use’. Evidence from the scientific community indicates the most significant contributor to the virus spreading between people is respiratory droplets in the air, known as aerosol transmission. Referencing ECB research, it also says the virus is transferred from cash to human fingers in such small quantities, they would not likely be infectious.

Our novel transferability testing results… show that the SARS-CoV-2 virus is only transferred from cash to the human finger in very low quantities. The levels are below what would be needed to be infectious.

On demand for euro cash, the paper notes ‘the growth rate during crises… has been extraordinarily high’, echoing a worldwide trend of people turning to the certainty and reliability of cash when other stores of value are uncertain or inaccessible. Annual growth rose by 12 percent in February 2021 compared with the last month before the pandemic spread across Europe (February 2020), compared with a typical annual growth of around five percent.

Despite a concurrent decrease in cash usage, an ECB IMPACT survey conducted in July 2020 found nearly half of respondents reported using around the same amount of cash they had previously, and 10 percent said they were using it more often. 39 percent said they were using it less often, and two percent were unsure of their cash use, or preferred not to say.

Of those saying they used less cash, 38 percent cited ‘risk of infection’ as a reason while 35 percent said they were following government recommendations to pay cashless when possible. 20 percent also reported pressure from businesses not to use cash, while nine percent said they were less able to withdraw banknotes than before the pandemic.