The Bank of England Says Cash in Demand and Safe to Use

The latest quarterly bulletin from the Bank of England (BoE) examines trends in cash use and the effects of the COVID-19 pandemic, revealing a new study that shows cash poses a low risk of transmission, and exploring why cash in circulation continues to grow.

Cash is an important part of the UK economy, with an estimated 9.3 billion cash payments made in 2019, and 2.1 million people using cash as their primary, day-to-day payment method.

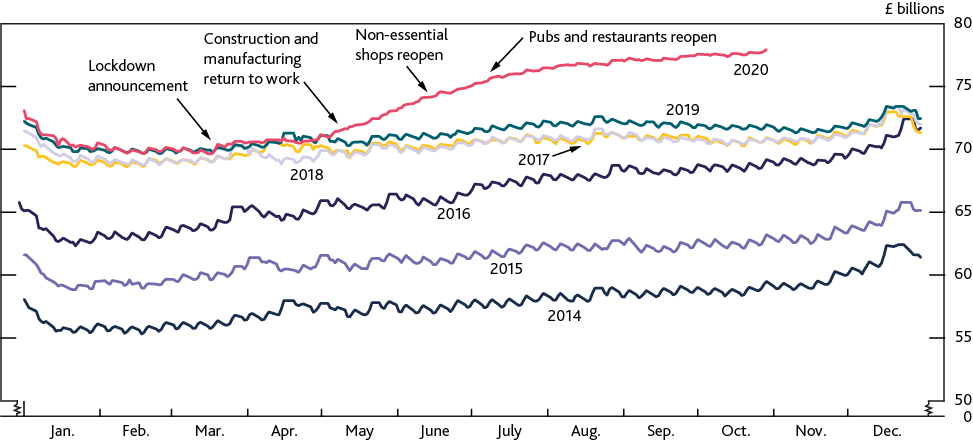

In 2020, although cash transactions have decreased, demand for banknotes has risen. This is a long-term trend, with the value of notes in circulation trending upwards since the early 1990s, and doubling between 2005 and 2017. This apparent paradox is driven by a growing role for cash as a reliable store of value, supported by historically low interest rates and inflation that reduce the opportunity cost of holding banknotes. There are also notable rises in cash demand when people have concerns about banks or the economy. From 2008 to 2010, with the population worried about the state of banking, they turned to cash for a tangible reserve of money.

These cash trends have been magnified by the COVID-19 pandemic, with the value of banknotes in circulation seeing a sharp rise since March 2020. This phenomenon has also been observed in the U.S. and across Europe.

Value of UK banknotes in circulation, 2014–2020 | Source: Bank of England

The pandemic has necessitated social distancing measures, which many have taken as encouragement to move towards contactless payments. Concerns around whether handling cash increases the risk of contracting Coronavirus (COVID-19), however, have been put to rest by scientific studies, including one recently commissioned by the BoE.

The most common transmission route is droplets and aerosols exhaled by an infected person. It may also be transmitted via droplets landing on frequently-touched surfaces such as door handles, hand rails and touch screens, and being picked up on someone else’s hands. The BoE observes ‘banknotes are not typically directly involved in these transmission routes, as they are rarely exposed directly to the environment.’

In the BoE study, a high dose of a coronavirus—representing a potential worst-case-scenario infection event—was applied to banknotes, both paper and polymer. Stainless steel and plastic surfaces were used for comparative purposes. The viral load on a banknote remained stable for around an hour after exposure, then declined rapidly over the following five hours. After six hours, the viral load had declined to five percent or less of the initial level on both types of note. Similar declines were seen on plastic and stainless steel, although in some cases it dropped more slowly than on banknotes.

The conclusions drawn from the study were that the virus does not survive at high levels on banknotes for very long. Even at high doses, the levels decline rapidly and ‘therefore associated risk of infection appears low.’ Also, the virus’s survival on banknotes was no greater—and indeed may be less—than on comparative plastic and stainless steel surfaces, of the sort people will typically touch regularly.

In a retail environment, the major infection risk is from directly breathing in exhaled droplets or aerosols when in close proximity to an infected person. High-touch surfaces such as basket and trolley handles, PIN keypads, touch screens, or products on open shelves could also pose a risk.

The relative risk of Coronavirus (COVID-19) transmission via banknotes is low | Source: Bank of England

The takeaways from this analysis by the Bank of England are that—while shopping and payment behaviours have changed in response to the virus—cash remains safe to use, and is appreciated as a tangible store of value that will always be available for use in emergencies.