Cash Me If You Can: The Impacts of Cashless Businesses... (Federal Reserve, 2019)

The Cash Product Office (CPO) paper observes the impact of newly cashless businesses on retailers, consumers and cash use as a whole, focusing on how banning cash may come with some economic benefits for retailers but at a severe cost for the consumer.

According to the data taken from the DCPC 2019 survey, it seems that the use of cash in the United States of America continues to decline but at a slower rate than the previous year. Cash is still used 'extensively' and continues to be the preferred payment choice for small-value transactions making up 49% of payments under $10.

The topic of cashless businesses is a complex and nuanced issue. On one hand, it can make economic sense for a business to go cashless. Transactions are faster, opportunities for theft are reduced, businesses may be less attractive robbery targets, and stores can eliminate cash handling costs. On the other hand, the move away from cash can symbolize, even inadvertently, support for financial exclusion of certain consumers. This trade-off raises a few philosophical questions: Do consumers have a right to use cash? Who bears responsibility for financial inclusion?

'The move away from cash can symbolize, even inadvertently, support for financial exclusion of certain consumers.'

While the legal landscape remains mixed, some retailers are backing off their cashless plans. In 2018, in response to strong customer feedback, burger chain Shake Shack decided not to go fully cashless in their restaurants; AmazonGo announced plans in March to enable customers to pay with cash; and famously cashless salad chain Sweetgreen announced in April of 2019 that all of its locations will accept cash again after experimenting with going cashless for more than two years.

“The purpose of this [law] is to ensure that all City residents—including those who lack access to other forms of payment—are able to participate in the City’s economic life by paying cash for goods and many services.”

The Rise of Cashless Businesses and their Impact on Cash

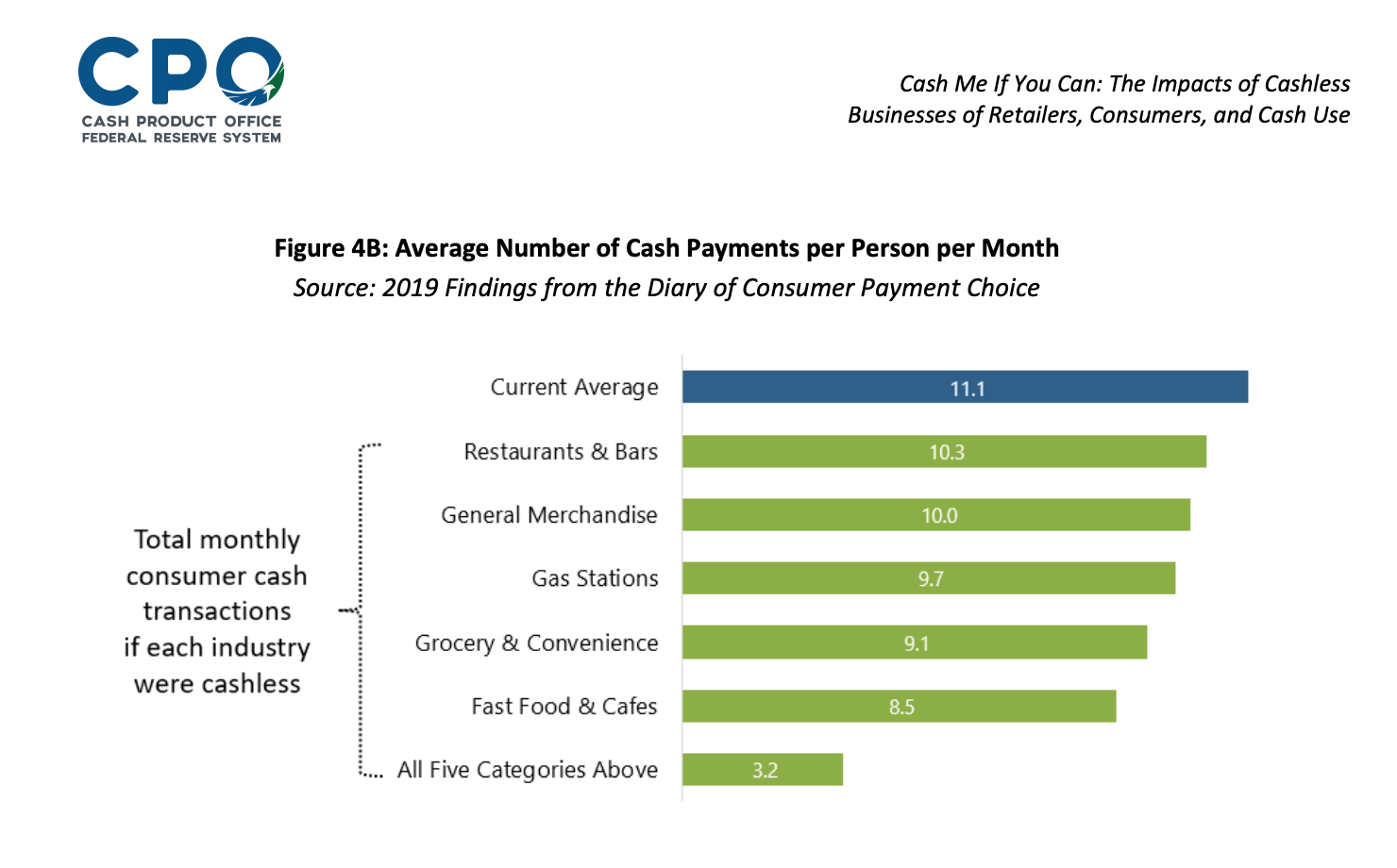

If the current trend of cashless businesses continues to gain momentum, the impact on consumer cash could be significant, particularly if the shift occurs in certain key industries.

Even if the legal tide turns against cashless businesses, other emerging retail trends pose similar risks to financial inclusion and to cash. One increasingly popular brick-and-mortar trend is the “showroom model,” where customers can physically try on and interact with products but ultimately purchase them online. Another retail trend is the $57 billion “on-demand economy,” where consumers can order goods, meals, and services instantaneously through their smartphones. While these innovations can offer tremendous benefits to both retailers and consumers, they pose similar questions around financial exclusion. Both require consumers to pay with some type of electronic or card payment, and both deny consumers the opportunity to use cash. Still, e-commerce’s share of total retail sales reached 10 percent in 2019, with no signs of slowing down or stopping.

About The Cash Product Office (CPO)

The CPO is responsible for strategic leadership to the Federal Reserve Bank cash departments by formulating policies, operational guidance, and technology strategies for U.S. currency and coin services provided nationally and internationally.