Findings from the 5th Diary of Consumer Payment Choice (Federal Reserve, 2019)

According to the data taken from the DCPC 2018 survey, it seems that the use of cash in the United States of America continues to decline but at a slower rate than the previous year. Cash is still used 'extensively' and continues to be the preferred payment choice for small-value transactions.

Key findings include

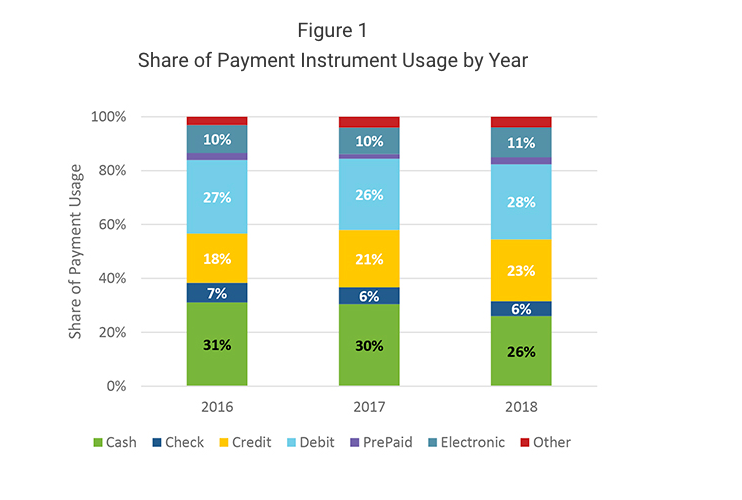

- Consumers used cash in 26% of transactions, down from 30% in 2017.

- Debit cards were the most used instrument, accounting for 28% of payments.

- Credit cards accounted for 23% of payments, a 2 percentage point increase from 2017.

- Cash was used heavily for small-value payments, representing 49% of payments under $10.

- The share of cash use among individuals under 25 years old is the highest of any age group.

- In-person payments accounted for 73% of all transactions. Participants used cash for 35% of in-person payments.

Excerpt from the Federal Reserve 2019 findings report

Individuals aged 18 to 25 have the highest share of cash use, 34%, followed by those 65 and older who report using cash for 33% of payments. The share of cash use is lowest for individuals between the ages of 25 and 44 years old, who reduced their average cash usage by two payments per month.

Debit cards are the most popular for this age cohort, used for approximately 14 payments, or 34%. While debit cards are the most popular for those 25 to 44, this group’s credit card usage has increased 9 percentage points from 2016 to 2018.

Cash is the second most used payment instrument

In 2018, Diary participants made an average of 1.4 payments per day, compared to the 1.3 and 1.5 payments per day diarists made in 2017 and 2016, respectively. These average daily payments equate to approximately 43 payments per month, including both bill and non-bill payments.

This year’s Diary is the first time participants reported debit cards as the most frequently used payment instrument, accounting for 28 percent of payments (Figure 1), while cash was second, used 26 percent of the time. Consumers’ credit card usage has steadily increased from 2016 to 2018, rising from 18 percent to 23 percent.

Lastly, the share of in-person payments declined 4 percentage points to 73% in 2018. For these in-person payments, cash is used 35% of the time, followed by debit and credit cards at 30 and 25%, respectively. The use of credit cards for in-person purchases increased from 20% in 2016 to 25% in 2018.

Related Content