War on Covid causes cash demand to plummet in the UK

While global cash demand has varied across the world since the emergence of Covid-19, the UK’s use of cash halved in the nation's first week of lockdown.

Misinformation, fake news, and concerns of cross-contamination have been cited by Brett Scott - activist and independent journalist - as a reason why Brits have moved away from cash in his recent article Why the War on Covid must not become a War on Cash. Read more

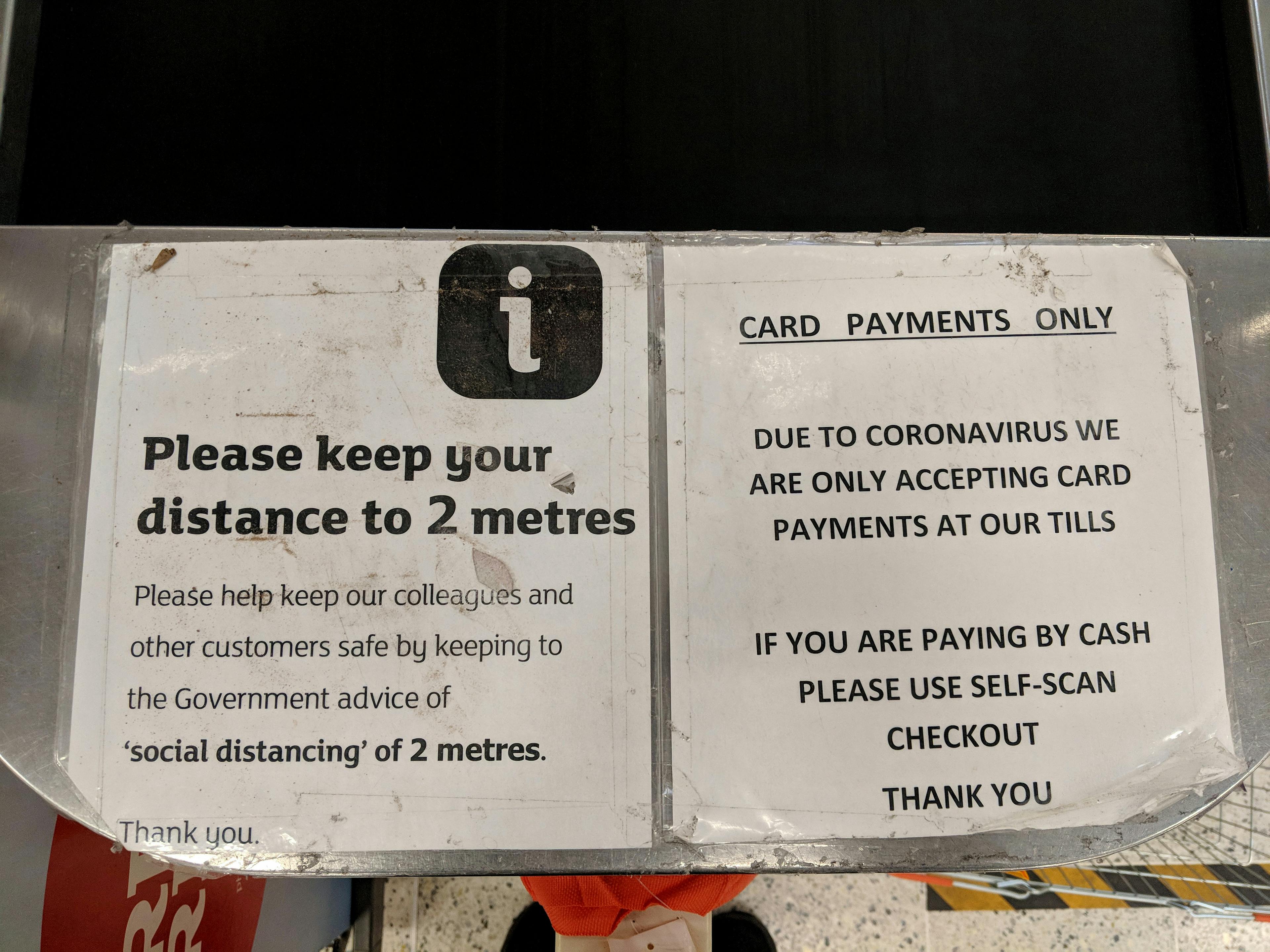

As Scott explains, the rhetoric circulating Covid communications in the UK has had a significant impact on public perceptions of cash. Narratives perpetuated by seemingly harmless service notices used in supermarkets, for example, are one of the contributing sources that have discouraged the use of cash for everyday transactions.

An example notice to customers from a British supermarket.

“Supermarkets, painfully aware of a duty to prevent the spread of the virus, openly order people to turn away from the public cash system and to use the [privatised payment] system for payments (‘please use contactless payment’).”

In his piece, Scott highlights that, contrary to fake news instigated by outlets like The Telegraph, “banknotes do not lend themselves to being an infection channel for coronavirus.” This point was echoed by the World Health Organisation who have since emphasised that cash does not transmit the Covid-19 virus and that they were originally misquoted.

While the rhetoric surrounding cash has encouraged a reliance on digital payment methods in the UK, contrasting behaviours have been reported elsewhere. By April 10, fellow Europeans had raised the value of euro banknotes distributed to individuals and businesses from €41.2 billion to €1.33 trillion. In Russia alone, 1 trillion rubles ($13 billion) in cash had been withdrawn from bank accounts amid Coronavirus fears. According to Newsweek, “the amount totalled more than was withdrawn in the whole of 2019.”

Outside of Europe, India has witnessed increased cash usage despite the demonetisation of high-value currency notes which had been imposed in 2016. By May 22, 2020, the currency within the public domain totalled over Rs 25 lakh crore, a significant increase from the week ending March 31, 2020, which reported Rs 23.5 lakh crore. And it’s not just India: Mexico has seen a marked increase in the use of cash during the pandemic. These reports estimate that, despite messaging from retail and media outlets, other countries are using cash as a contingency which is expected behaviour during times of uncertainty.