In the US, people hold more cash than ever before, says FED

Last week, the Federal Reserve published its findings from the 6th Diary of Consumer Payment Choice (DCPC), which includes part of the DCPC 2019 survey and an additional post-outbreak supplement survey.

The supplement asked 10 Covid-19 survey questions comparing payment behaviour in response to covid-19 with the data from the 2019 diary. In general, “participants reported holding more cash on their persons and especially as a store of value in their homes, compared to trends reported in the 2019 Diary.”

Key findings include

- Approximately 20% of participants have switched to paying online or over the phone, with most of the switching taking place at restaurants, fast food locations, and big-box stores.

- 70% of individuals said they were not avoiding cash.

- Nearly two-thirds had made no in-person payments since 10th March; while these individuals were not necessarily deliberately avoiding cash usage, it implies people are not spending their extra cash holdings.

Excerpts from the Federal Reserve 2019 and Supplemental Survey 2020

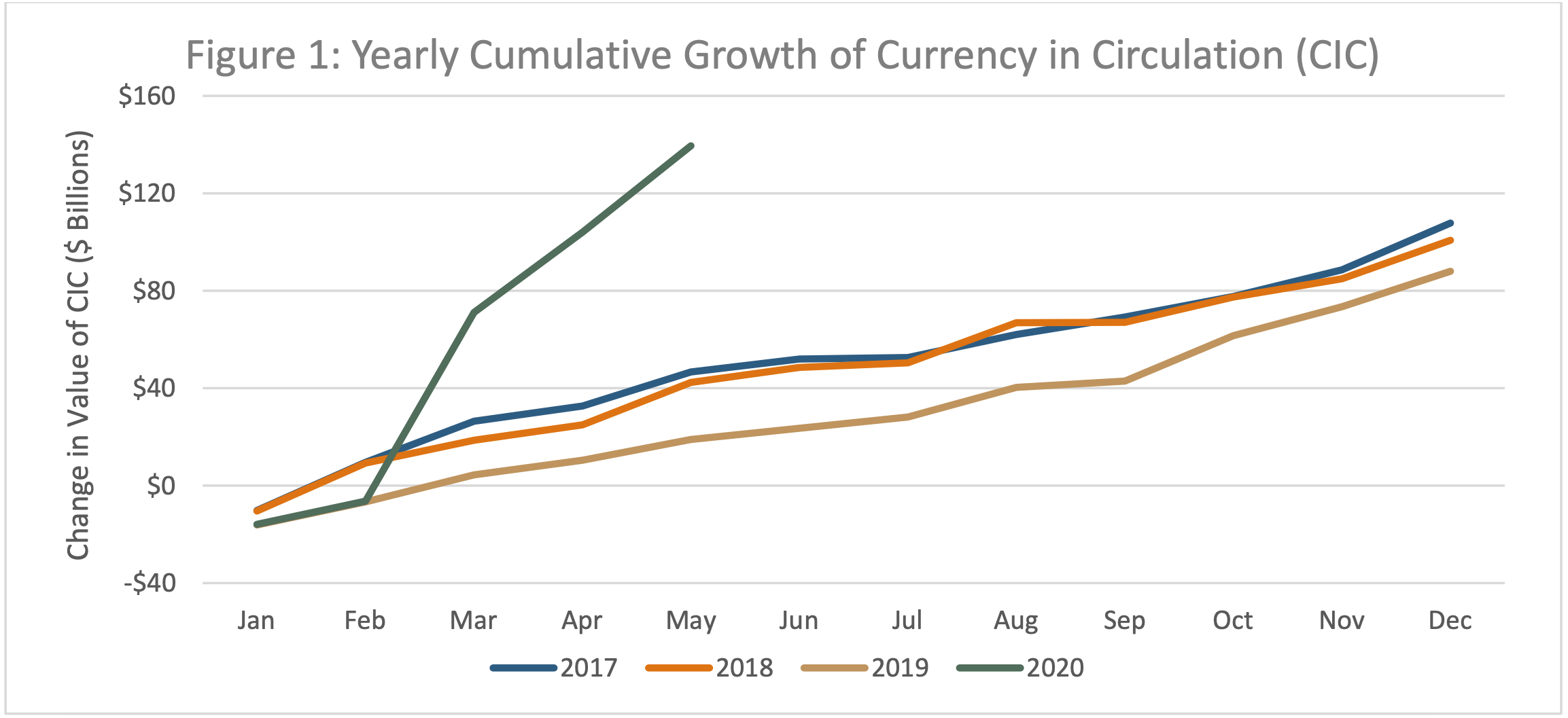

Global demand for U.S. currency increased at record rates. Since March 1, the Federal Reserve has issued approximately $130 billion of currency into circulation.

In general, participants reported holding more cash on their persons and especially as a store of value in their homes, compared to trends reported in the 2019 Diary.

Section 1. People are holding more cash

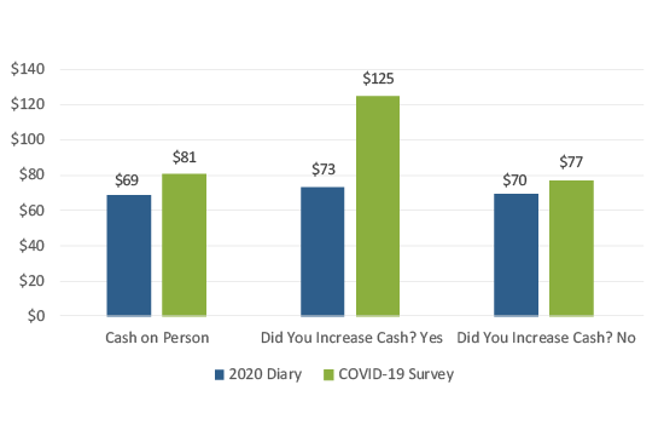

On average, the amount of cash people carry increased from $69 to $81, a 17 percent increase from the pre-pandemic amount reported in the 2019 Diary. Holdings increased by 71 percent to $125 for individuals who withdrew extra cash and by 10 percent to $77 for those who did not withdraw extra cash.

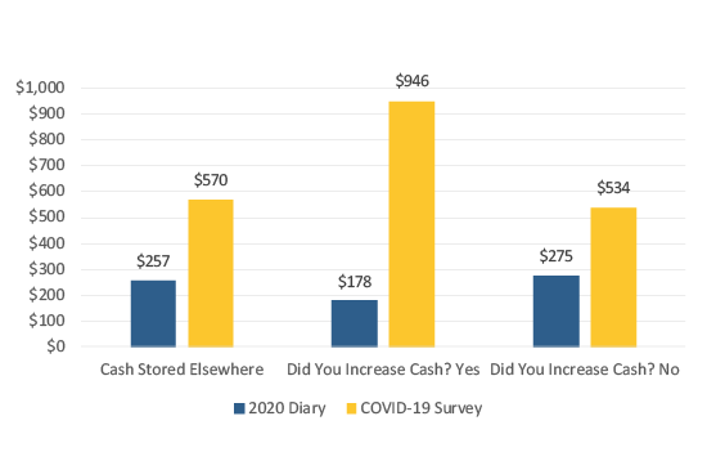

The value of cash stored elsewhere was far greater for all respondent groups compared to pre-pandemic amounts. On average, cash stored elsewhere more than doubled, rising from $257 to $570 (Figure 3). Those who withdrew extra cash increased their holdings by 431 percent, jumping from $178 to $946, and those who did not withdraw extra cash increased their holdings by 94 percent, rising from $275 to $534.

Section 2 Many people did not make in-person payments

Of the individuals who reported making in-person payments, 59 percent used cash at least once, a similar rate to the 57 percent of individuals who used cash at least once in the 2019 Diary. The similar rate at which cash is being used in person suggests that stories on the erosion of payment preferences during the pandemic may be overstated.

Section 3. Most people are not avoiding cash

The majority of survey respondents claim they are not avoiding using cash. Although 28 percent stated they are avoiding using cash, they continue to hold more of it during the pandemic.

Covid’s impact on cash is not yet known

The 2019 Diary of Consumer Payment Choice was the last consumer payments study conducted by the Federal Reserve before the world was exposed to COVID-19. It is unknowable whether consumers’ payment behaviours will change permanently as a result of the pandemic. Our current information demonstrates that transactional use of cash has decreased and its role as a store of value has increased, while domestic and international demand continues to substantially increase.