U.S. Federal Reserve Finds Cash Holdings Up and Usage Down

Newly-published figures from the Federal Reserve annual payment study show Americans are holding more cash, while fewer opportunities for in-person spending have led to a decline in usage.

The Diary of Consumer Payment Choice—conducted every October—illustrates payment trends and habits of the U.S. population. This year’s study reflects the changes wrought by COVID-19 and notes that it is unclear whether or not the changes seen will continue as the pandemic subsides.

Regardless of how the payments landscape evolves, it is important to note that consumers continue to use cash, though at a lower rate, even amid a pandemic.

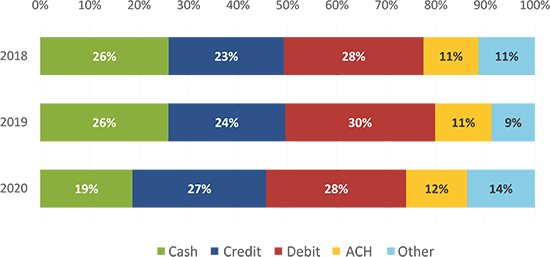

The results showed consumers made fewer payments overall, with the October 2020 average 34 compared with 39 the previous October. Of these, cash was used for 19 percent, down from 26 percent in 2019, while the average value of cash held on each person rose by $20 dollars over the same period to a total of $74. 72 percent of people reported making in-person payments over a three-day period, down from 91 percent in 2019.

Share of Payment Types by Year, Federal Reserve Bank of San Francisco

Due to the pandemic, U.S. consumers limited their in-person activities, and governments issued shelter-in-place orders, many of which remained in place throughout the fall period. This led to shoppers consolidating their purchases into fewer transactions, with the average spend $4,760 in 2020 compared to $4,326 in 2019.

The study highlighted a decrease in cash use for small transactions—defined as payments of under $25—with a concurrent rise in credit and debit card use for these amounts. It concluded that this decline is largely responsible for the overall reduction seen in cash use, rather than substitution of cash payments with cards. It also noted that some retailers were actively discouraging the use of cash, reducing the payment choice available to consumers.

The increase in cash holdings was seen across all adult age groups and household income levels, and was considered a noteworthy shift given amounts had previously been quite stable. Individuals aged 18–24 in particular almost doubled their daily holdings, from $33 to $60. The study suggested these observations may be explained by ongoing uncertainty caused by the pandemic, rather than relating to economic impact payments and supplemental unemployment benefits. In other words, people trust most in tangible values, i.e. cash.

The study concludes that, as expected, its findings for 2020 were significantly different from prior years, with the pandemic driving a reduction in total payments, largely caused by fewer in-person transactions, which account for around 80 percent of all payments. While consumers continued to use cash for nearly 20 percent of transactions, the increase in online shopping reduced opportunities to choose it.