The 2019 FinAccess household survey (Central Bank of Kenya, 2019)

On April 3rd, 2019 the Central Bank of Kenya published its latest report on cash use titled, "The 2019 FinAccess household survey", fifth of its kind.

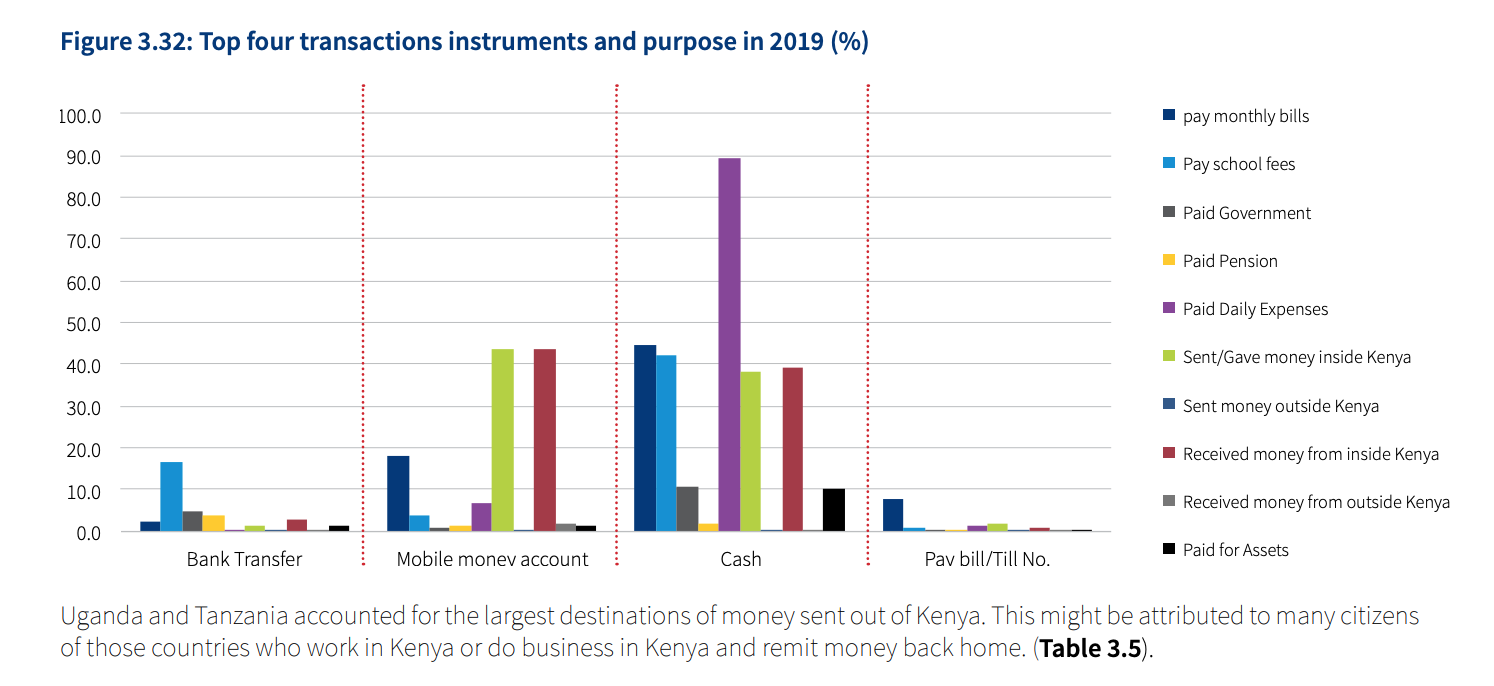

Kenya, home of the M-Pesa, is often referred to as an example for mobile money success. Still, as this report shows, the most used payment instrument for transactions continues to be cash, "used widely for daily expenses, monthly bills payments, fee payments, sent or receive money and purchase of assets" (Figure 3.32).

Because cash is universal, straight-forward and does not require an electronic infrastructure, cash is the dominant payment tool for agriculture and business across Kenya's rural areas.

Some key findings from the 2019 FinAccess report include:

- In Kenya 92.6% of agricultural payments are done with cash,

- Formal financial inclusion has risen to 82.9%, up from 26.7% in 2006,

- Complete financial exclusion has narrowed to 11.0% from 41.3% in 2006.

Last Updated: Jan 12, 2024