Findings from the 4th Diary of Consumer Payment Choice (Federal Reserve, 2018)

The DCPC collects data from a demographically-representative sample of approximately 2,800 individuals participating in the Diary in October 2017. The main takeaway from this report is that 'cash was the most used payment instrument overall'.

Key findings include:

- Cash represents 30% of all transactions and 55% of transactions under $10.

- While online shopping continues to grow, 77% of payments were made in-person.

- For in-person payments, cash accounts for 39% of the volume.

- People of 18-25 years of age and those 45 years and older use cash 34% of the time.

- In 2017, consumers held more cash on average than their 2015 and 2016 counterparts.

Excerpt from Federal Reserve report

As retailers and payment providers compete to deliver new ways to shop and pay, data from the 2017 DCPC shows that consumers continue to demand and pay with cash about as frequently as in previous years and that their usage is relatively similar across age groups. In particular, cash remains a popular payment method for small value transactions. Furthermore, when considering preferences, cash remains a preferred secondary payment choice regardless of what payment instrument consumers prefer to use primarily.

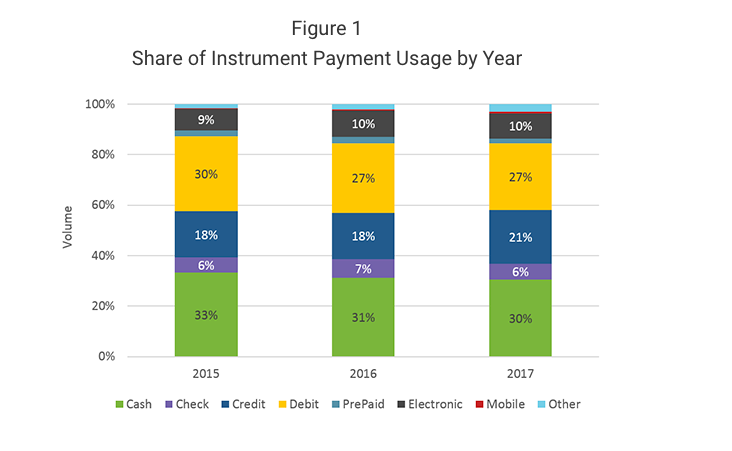

In addition, the 2017 DCPC also indicates that individuals are holding more cash than previous years, particularly at the lower and upper bounds of the income distribution. While cash continues to be the most frequently-used payment instrument, its share of payments declined modestly in 2017 from 31-30%.

The 2017 DCPC data also show that in-person transactions make up more than 75% of all transactions indicating that, despite the growth in opportunities to shop and pay online, most transactions still take place in-person. For these in-person payments, cash represents a large share (39%) of transactions. Even when looking at cash use by merchant type, cash continues to be a popular payment instrument for a variety of retailers.

The 2017 DCPC illustrates the prominence of cash use across age groups, households, and merchants. These findings demonstrate the important role cash continues to play in commerce.

Download Federal Reserve report here

Related Content