Surging Data Breaches Highlight the Value of Cash

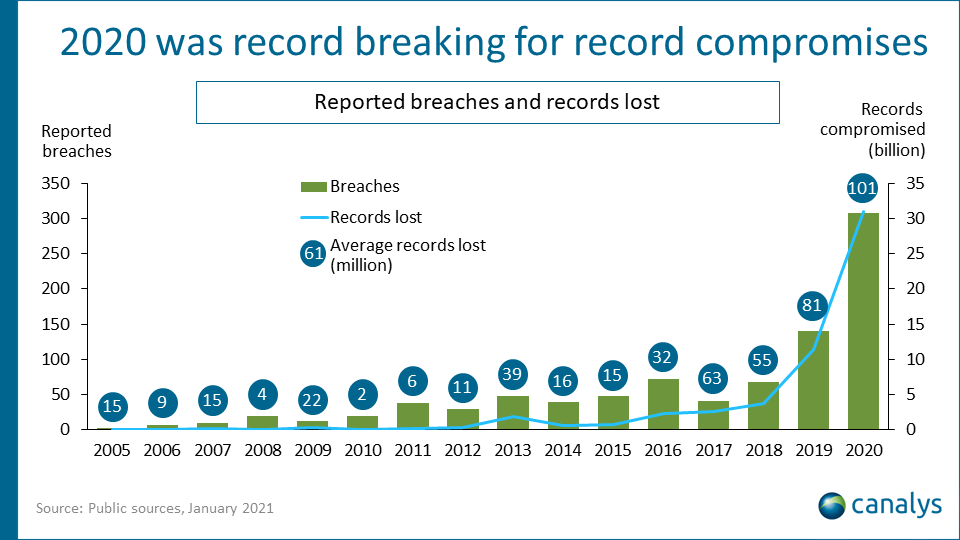

Last year, data breaches reached unprecedented heights, with more records compromised in just 12 months than in the previous 15 years combined, according to new research. In a digitally-driven world, the unique anonymity and security of cash are critical commodities.

Canalys—a global technology market analyst firm—recently published troubling data that indicates cyber attacks are increasingly being carried out by highly organised and sophisticated groups, rather than lone, opportunistic hackers.

Also, as many high-profile organisations went out of business in 2020, surviving organisations were obliged to rapidly implement changes to their operating models to avoid the same fate. These swiftly-enacted measures often came at the expense of cybersecurity, according to the report, and bypassed long-standing corporate policies, leaving many exposed to criminal exploitation.

Digital payments are linked to identities and personal information, which can be exposed by data breaches, allowing criminals access to bank accounts they can empty, and personal data they can use fraudulently. The more cashless payments an individual makes—especially in different places—the greater their risk when systems are compromised. This means payment choice is more critical than ever.

Cash can be used anonymously, with only the parties directly involved in a transaction having any knowledge of each other. This unmatched privacy makes it a highly valuable element of the payments landscape, offering people another way to pay, so they can select the best option depending on their circumstances, the specific nature of a transaction and the parties involved.

The cybercrime surge is a serious concern worldwide, with some suggesting it poses a risk of destabilising the global economy. Chair of the U.S. Federal Reserve Jerome Powell recently underscored the immense importance of investing properly in robust security measures in a CBS news interview.

I would say the risk we keep our eyes on most now is cyber risk. There are scenarios in which a large financial institution would lose the ability to track the payments it’s making, where you would have a part of the financial system come to a halt.

Cash offers a secure and anonymous payment option, and its value extends from the national scale right down to the personal. To prepare for emergency situations, where electricity or internet connections may not be available, or instances of losing access to an account due to fraudulent activity or even overzealous security measures, it is always advisable to keep some cash in a safe, readily-accessible place.