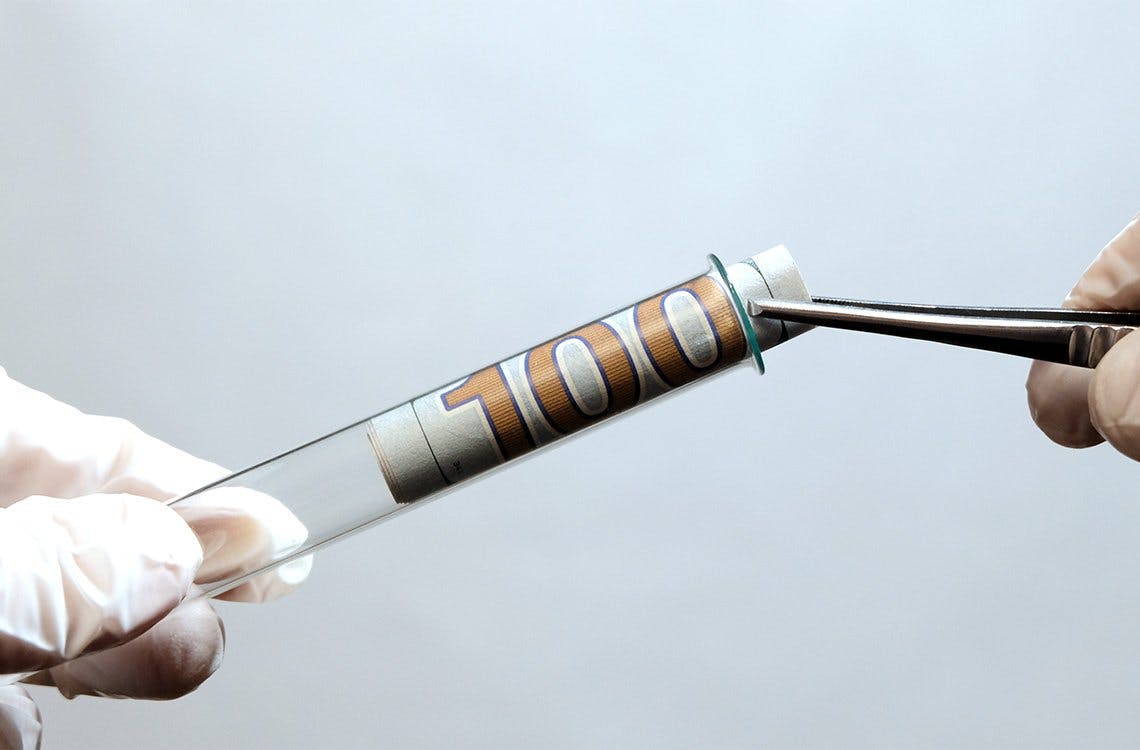

The Scientific Case for Cash

In the ongoing discussion about cash and high-denomination banknotes, a study recently published in the Latin American Journal of Central Banking outlines the arguments for retaining ‘high-denomination cash in the U.S.’

The real reason for the “war on cash”

Author James McAndrews, of TNB USA Inc. and Wharton Financial Institutions Center, frames his study as a response to claims made by cash opponent Kenneth Rogoff as early as 2014 that eliminating high denomination notes—specifically $50 and $100 bills in the United States—would reduce crime and terrorism.

Rogoff’s arguments have been refuted by many experts, including:

- Dr Ursula Dalinghaus, from the Institute for Money, Technology and Financial Inclusion (IMTFI), Irvine California, in her 2017 white paper ‘Keeping Cash’;

- The think tank Center for European Policy Studies (CEPS) in its ‘Study on an EU initiative for a restriction on payments in cash’, conducted for the European Commission in 2018;

- Prof Dr Friedrich Schneider, University of Linz, et al. in a study for the Bundesbank 2019.

That Rogoff persists in this reasoning—painting cash as the culprit for criminal activities, despite all evidence to the contrary—is due to his actual agenda: seeking to eliminate the zero lower bound, using negative interest rates as a macro-economic tool to stimulate consumer spending. Cash is the biggest obstacle to this economic objective, since people can simply withdraw their money from banks in cash and store it elsewhere, thus avoiding negative interest rates. Without cash, there is only a choice (or rather non-choice) of losing money to banks, or spending money and boosting the economy.

Eliminating high-denomination cash would foster organised crime

McAndrews does not necessarily disagree with Rogoff’s assumptions, process and conclusions. His diverging verdict—that it is far better to keep high denomination cash—is based on a twofold scientific approach: mathematical equations combined with deduction from analogies.

Using the results of programs in which a good usually available has been restricted, he shows ‘it is fallacious to assert that if people do not use a good, such as condoms or clean needles, they are unharmed by a restriction on the supply of those goods.’ (p. 4)

Consequently, analogous to the results from these programs, if large notes were withdrawn, criminals would seek other revenue streams, potentially more harmful than cash. They would need to be anonymous and hard to track, so other forms of payment (such as bank transfers, cheques and credit cards) would not be suitable. Andrews refutes Rogoff’s proposed replacements and concludes systems of debt—demanding criminal enforcers to ensure payment—would prove to be ‘substitutes for high denomination cash in payments related to illicit and illegal activities’ (p. 5). He asserts eliminating cash would actually foster organised crime, saying ‘[…] the type of crime selected by the availability of the new payment method [i.e. debt] is facilitated by organized crime. As a result, organized crime would expand, and legitimate businesses would be suborned.’ (p. 5)

He concludes that 'eliminating high-denomination currency creates a worse type of crime than the type it displaces.'

Cash is available free of charge, and its benefits include anonymity, easy verifiability, and widespread acceptance. Debit cards and the accounts that fund them [...] are lacking such features. At present, it is unlikely they represent realistic cash alternatives for poor and unbanked people.

Cash is indispensable for financial inclusion

There are many reasons a person may find themselves unable or unwilling to open a bank account—from a checkered debt history to simple lack of access to banking facilities—and for this ‘unbanked’ group, cash is their primary way of earning and paying. India's infamous 2016 demonetisation policy proved disastrous, and Andrews picks up on this example as a cautionary tale of the risks of eliminating certain currency denominations.

The potential rise in organised crime, the uncertain benefits of negative interest rates and the obvious downsides for the unbanked presented by Andrews, using the sobering outcome of India's demonetisation gambit as an example, make a compelling argument against the elimination of high-denomination currency.

Cash is a social contrivance that helps people, who are sometimes in vulnerable positions, to alleviate their concerns and discharge their obligations with finality.