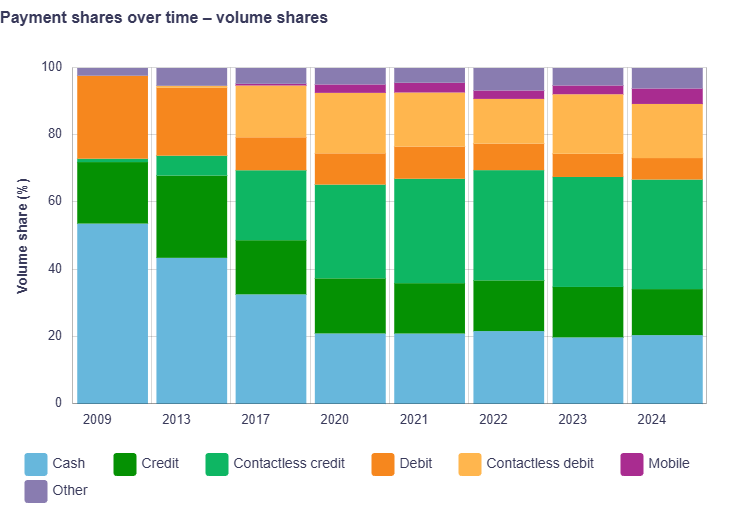

Analysis of the Bank of Canada’s 2024 Methods-of-Payment (MOP) Survey reveals a compelling truth: despite accelerating digital adoption, cash has stabilized its position in the Canadian payment ecosystem, moving beyond a mere “backup” into a structurally essential payment method for diverse populations.

The narrative of an unstoppable decline in cash use has paused since 2020, replaced by one of surprising stability and persistent reliance among key demographic segments.

Cash's Stable Foothold in the Payment Landscape

The data from the 2024 MOP Survey confirms that the use of cash has remained consistent since 2021.

- Volume Share: Cash accounted for 21% of all purchases by volume in 2024, a figure remarkably stable compared to 20% in 2023. This places cash as the third-ranked method of payment at the point of sale, a position it has maintained since 2020.

- Value Share: By dollar value, cash made up 11% of all purchases in 2024, a percentage identical to that observed in 2023.

- Holdings Increase: The average amount of cash Canadians kept on hand in their wallets, purses, or pockets increased nominally, rising from $140 in 2023 to $156 in 2024. This rise was primarily driven by larger cash holdings among the upper three deciles, and an increase in the share of Canadians holding larger denomination notes ($50 and $100).

- Withdrawal Frequency: Canadians increased their use of automated banking machines (ABMs) in 2024, making ABM withdrawals an average of 2.1 times per month, up from 1.7 times per month in 2023.

The stability in cash use is further underscored by consumer sentiment: 79% of Canadians report having no plans to stop using cash in the future.

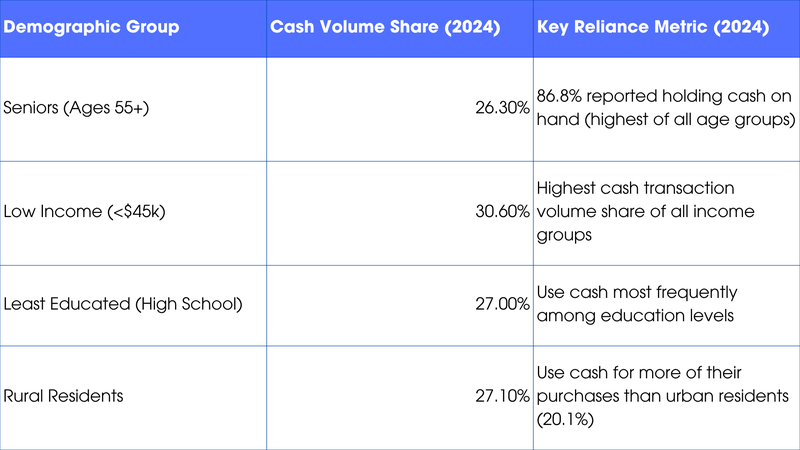

The Pockets of Essential Reliance

While mobile payments and contactless card use gain traction, the necessity of cash for certain Canadian households is irrefutable. The MOP data illuminates distinct segments where cash is not merely an option, but a primary tool for financial management and access.

- Financial Management: For low-income Canadians (<$45k), cash is demonstrably essential, accounting for 30.6% of their transaction volume. These individuals are less likely to own a credit card (77.3%) and have the lowest volume shares for mobile payments (1.2%), suggesting digital payment adoption is neither universal nor accessible for this segment. Cash provides a critical means for budget control where other options may incur fees or require a credit facility.

- Generational Preference: The highest share of Canadians holding cash on hand belongs to the 55+ age group (86.8%). This group also uses cash for the largest share of purchases (26.3% volume share). For them, cash is clearly the preferred, familiar, and most reliable method, even though their rate of credit card ownership is high (92.8%).

- Geographic Inclusion: Residents in rural areas rely on cash and debit for a greater portion of their payments (27.1% cash volume share) compared to urban dwellers (20.1% cash volume share), highlighting cash's ongoing function in less densely populated or connected regions.

Cash as a Foundational Utility

The findings prove that cash is more than a preference; it is a foundational utility in the Canadian financial landscape.

- Security and Acceptance: The vast majority of merchants continue to accept cash at the point of sale. Cash is the most widely accepted method of payment.

- The Transaction Size Divide: Cash is predominantly used for low-value purchases, with an average size of only $25. Credit cards, by contrast, are used for larger purchases, averaging $57. This disparity underscores cash’s role in micro-transactions and everyday expenses, solidifying its utility for daily budgeting.

- Access to Cash is Stable: Canadians’ perception of access remains overwhelmingly positive. In 2024, 67% of Canadians felt it was easy or very easy to access an ABM to withdraw cash. The perceived difficulty of access (12% difficult or very difficult) has barely shifted since 2023 (11%), refuting arguments that accessibility is collapsing.

The 2024 MOP Survey is a clear directive: cash is resilient, its use is stable, and it remains essential for a financially vulnerable and choice-seeking Canadian public. Any policy discussion regarding the future of payments must acknowledge that for millions of Canadians—especially the elderly, those on limited incomes, and those in rural areas—cash is a lifeline that ensures access and control in an increasingly digital world.