Kiwis demand to keep cash, making New Zealand "far from cashless"

Nearly 2,300 responses from the public were collected between June 19th and August 31st, informing the central bank's recent decision to safeguard cash use. The report concludes that there is "strong public support" to keep cash an option by ensuring its access and availability. Even if New Zealanders are using cash less, they "will not tolerate a cashless society", reports Stuff.

"The public has sent a clear message to the Reserve Bank that people would not tolerate moves to make New Zealand a cashless society."

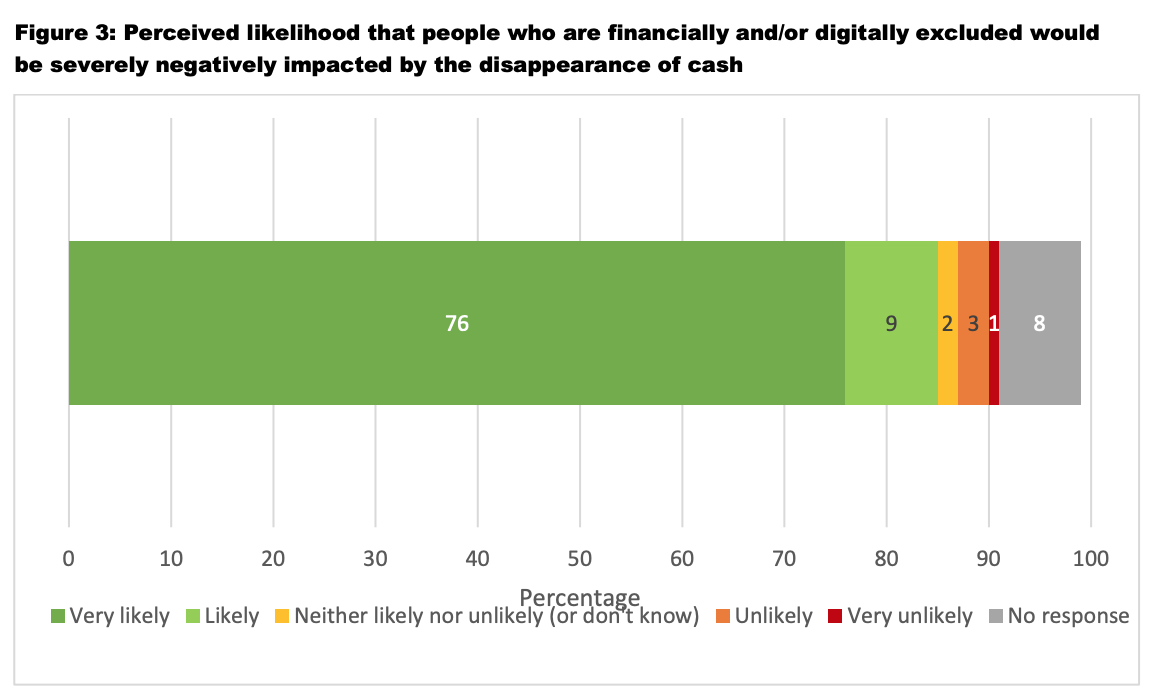

While New Zealand's currency in circulation rate is growing, the rate of growth is much lower than other economies, still, an overwhelming percentage of citizens defend the needs of the financially or digitally excluded as a reason to safeguard cash acceptance. The majority of all respondents (85%) agreed with the Bank’s view that people who are financially excluded could be severely negatively impacted if cash becomes difficult to get or use in New Zealand. However, when asked for suggestions on how to stop cash from being "phased out", most were unsure.

Key suggestions include

- 14% of respondents suggest new laws and legislation to ensure cash continues to be available as a payment option;

- 4% suggest that community groups, families and individuals could fight for the right to stop cash becoming hard to get by petitioning or lobbying the government; and

- Many other respondents suggested, "do nothing/not change anything/keep the status quo", saying the bank should continue producing cash (21%), retailers should keep accepting cash (19%) and individuals should keep spending it (13%).

The central bank published an Issues Paper the day the consultation opened. The report laid out some of the main concerns about a cashless society, asking survey participants to reflect on what it would mean to them to give up the liberties that cash guarantees.

Key issues include

- Severely excluding from society people who are already financially or digitally excluded,

- Negatively effecting tourists, people in some Pacific islands and people who use cash for cultural customs,

- All members of society would lose the freedom and autonomy that cash provides,

- All member of society would also lose an important back-up form of payment, exposing them entirely to national and personal cyber threats,

- Impact on the individual's ability to budget, the country's financial stability and government revenue.

Excerpt from report

"CIC trends indicate that cash is being used less for transactions and more as a store of value in New Zealand and other advanced economies. This dynamic provides impetus to consider whether the government should respond to the strict bottom-line incentives faced by cash suppliers.

"It really touched the heart and soul of an enormous amount of people. They really wanted the right … to have access to, and or, to use cash,"

The total value of CIC in New Zealand is increasing as a percent of nominal GDP and on a per-capita basis (figure 2). International studies suggest that New Zealand’s CIC trend could be due to an increasing demand for cash as a store of value over time and a falling demand for cash as a medium of exchange." (RBNZ, 2019, pp. 14-15)

Even though Kiwis are using cash less, appreciation for cash as a store of value and as fundamental right is clear from this report, a sentiment echoed over 300 comments under the Facebook post from Stuff.co.nz.