Insights Into the Future of Payments

Major shifts in payment behaviour related to the pandemic may not be permanent, and cash could continue to play a prominent and essential role in the future payments landscape, according to a cross-country study by the Bank for International Settlements.

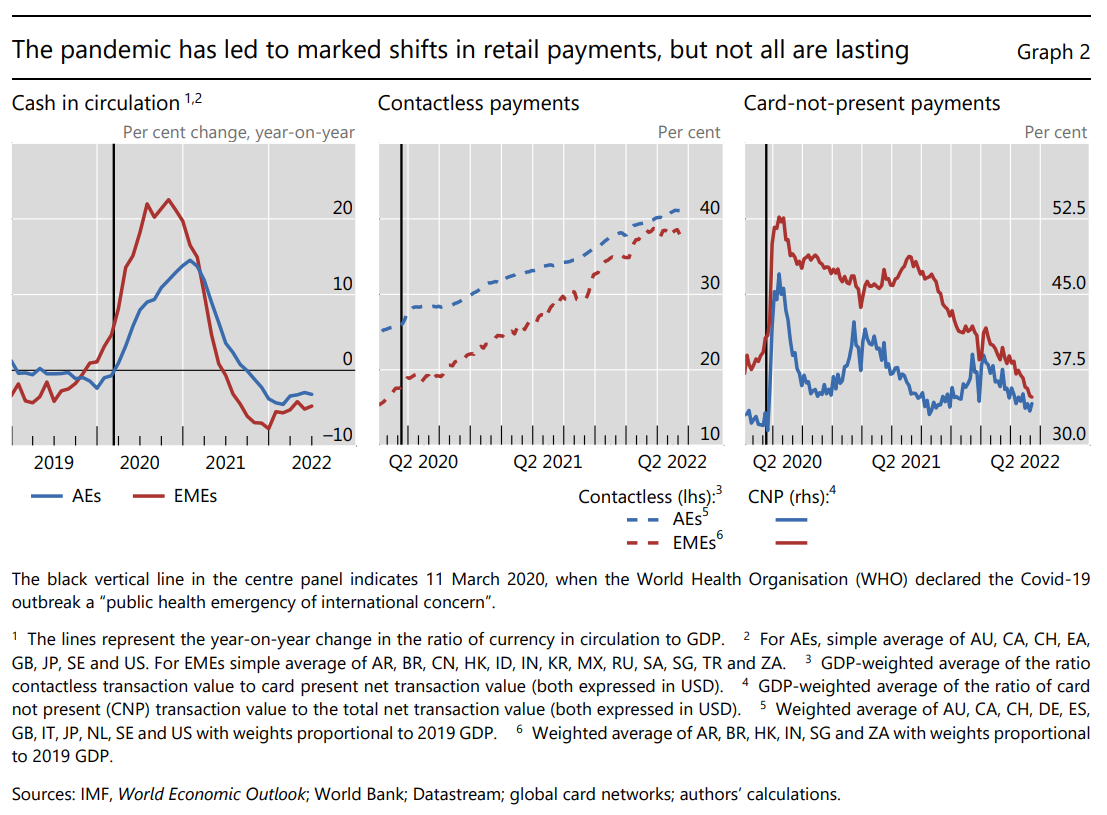

While circulating cash soared in most countries—with people seeking the reassurance of physical money and holding it as a store of value in uncertain times—the pandemic saw the use of banknotes and coins decline as payment behaviour changed and face-to-face transactions dropped in many nations.

The Pandemic, Cash and Retail Payment Behaviour: Insights from the Future of Payment Database examines payment behaviour data from 95 countries between September 2019 and June 2022, observing that card payments plus the download and usage of payment apps rose in weeks where countries experienced the most stringent lockdowns, but ‘recent data suggest that some effects reversed once lockdowns were eased, and mobility rebounded.’

A key finding is that the impact of lockdowns and the pandemic has partly reversed, suggesting that retail behaviours may change slower than some have anticipated, and that cash may continue to play a vital role going forward.

While contactless payments continue to see greater popularity, card-not-present payments—typically used for online purchases—spiked during the acute phase of the pandemic and fell once again as people returned to in-person shopping. The report shows ‘CNP payments are near their pre-pandemic levels in advanced economies, and even slightly below pre-pandemic levels in emerging market economies.’

The report also discusses ‘disparity in access to payment instruments’ with those who prefer to pay cash—including unbanked individuals and those who choose not to or are unable to use card and other cashless options—being at a disadvantage in economies shifting away from cash. It suggests ‘this might be a major argument in the future, calling for a stronger role for physical currency’, concluding that cash will continue to matter for the foreseeable future.

The sudden shift to card payments made it painfully clear that not all consumers have access to payment cards, bank accounts and digital wallets… Uniform access to payment services is crucial in promoting equitable and sustainable development, and a precondition for international convergence of living standards.