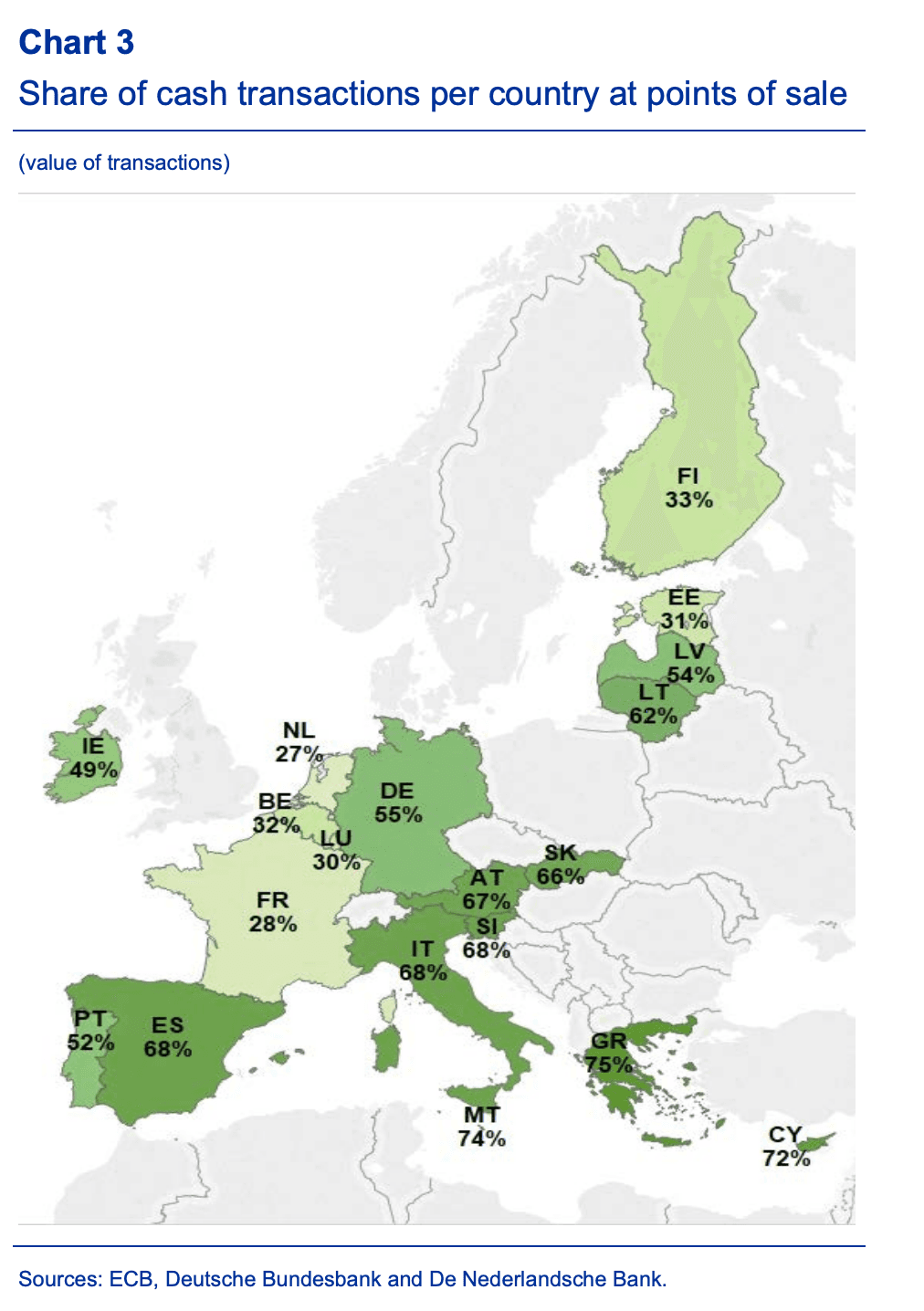

In Malta, cash is used for 74% of point-of-sale payments in terms of value (ECB, 2017)

The report presents estimations of the number and value of cash transactions in all 19 euro area countries in 2016, based on survey result as well as figures on main payments by demographic.

According to the findings from the European Central Bank's report, cash was used for 74% of point-of-sale payments in Malta in terms of value of transactions (ECB, 2017).

Excerpts from ECB Working Paper

In 2016, euro area consumers made 163 billion payments by means of cash, payment cards or other payment instruments, amounting to more than €2,968 billion (see Table 3). 18 The large majority of these payments were made in shops for day-today items, restaurants and petrol stations, as well as at street merchants and shops for durable goods. These payments are referred to as POS... (p. 18)

Survey results show that cash was dominant at the POS. In terms of number of transactions, 78.8% of purchases at the POS were paid using cash, 19.1% using cards and the remaining 2.1% was paid using various other payment instruments. In terms of value, cash payments accounted for 53.8% of all POS payments, cards for 39% and other means of payment accounted for the remaining 7.2%. (p. 19)

In 2016 euro area consumers made 1.6 payments per day on average, which equals nearly 11 payments per week (see Chart 5). They used cash more frequently than other payment instruments, making on average 1.2 cash payments per day, i.e. almost nine per week. (p. 22)

In terms of value, the share of cash was highest in Greece, Cyprus and Malta (above 70%). (p. 4)