Findings from the 3rd Diary of Consumer Payment Choice (Federal Reserve, 2017)

The data gathered from the DCPC 2016 survey show that 'the public’s demand for cash continues to grow as the amount of currency in circulation reached $1.43 trillion in October 2016'. The report also confirms that cash continues to be the most frequently used payment instrument, representing 31% of all consumer transactions.

Key findings include

- Approximately 60% of in-person payments under $10 were made in cash, compared to 20% of in-person transactions for $25 or more.

- Cash is held and used by a large majority of consumers, regardless of age and income; however, how it is used varies across demographic groups.

- Consumers’ opportunities to use cash are limited to in-person transactions for the most part. In 2016, only 75% of all payments were conducted in person.

Excerpt from the Federal Reserve 2017 findings report

The public’s demand for cash continues to grow as the amount of currency in circulation reached $1.43 trillion in October 2016. In addition, data from the Federal Reserve’s Diary of Consumer Payment Choice (DCPC) shows that cash remains the most frequently used payment instrument accounting for 31% of all consumer transactions.

Section 1. Demand for currency is growing, particularly as a store of value

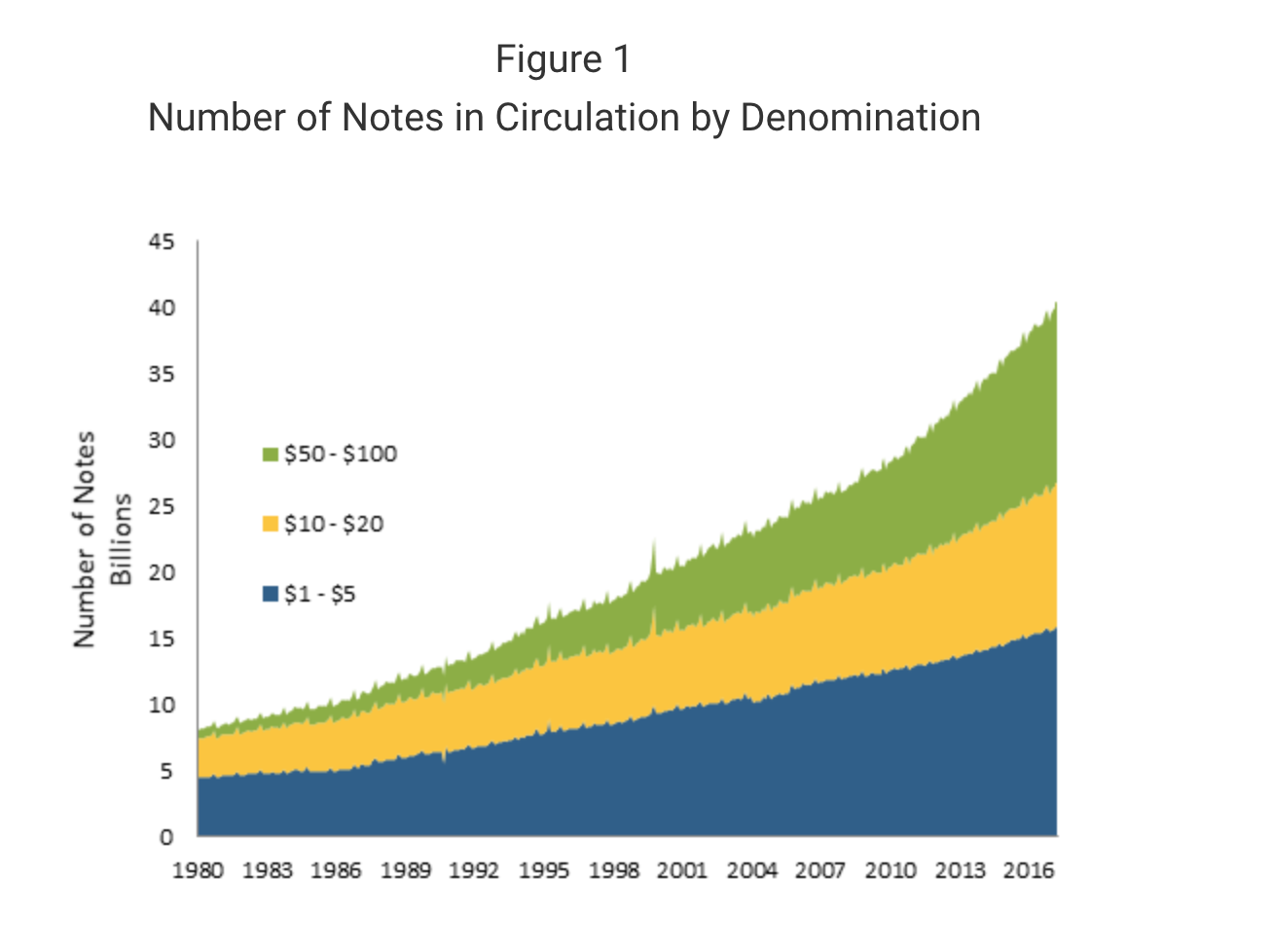

As highlighted in a recent posting by Federal Reserve Bank of San Francisco President John Williams, demand for cash is on the rise, both in the United States and across the globe. Figure 1 shows the growing demand for all denominations of U.S. notes, with particularly strong demand for high value denominations.

Since 2009, the compound annual growth rate (CAGR) for the number of notes in circulation has been 5.6 percent, with the value of currency in circulation growing at a 7.4 percent annual growth rate.

Section 2. Cash is widely used, and heavily used for smaller purchases

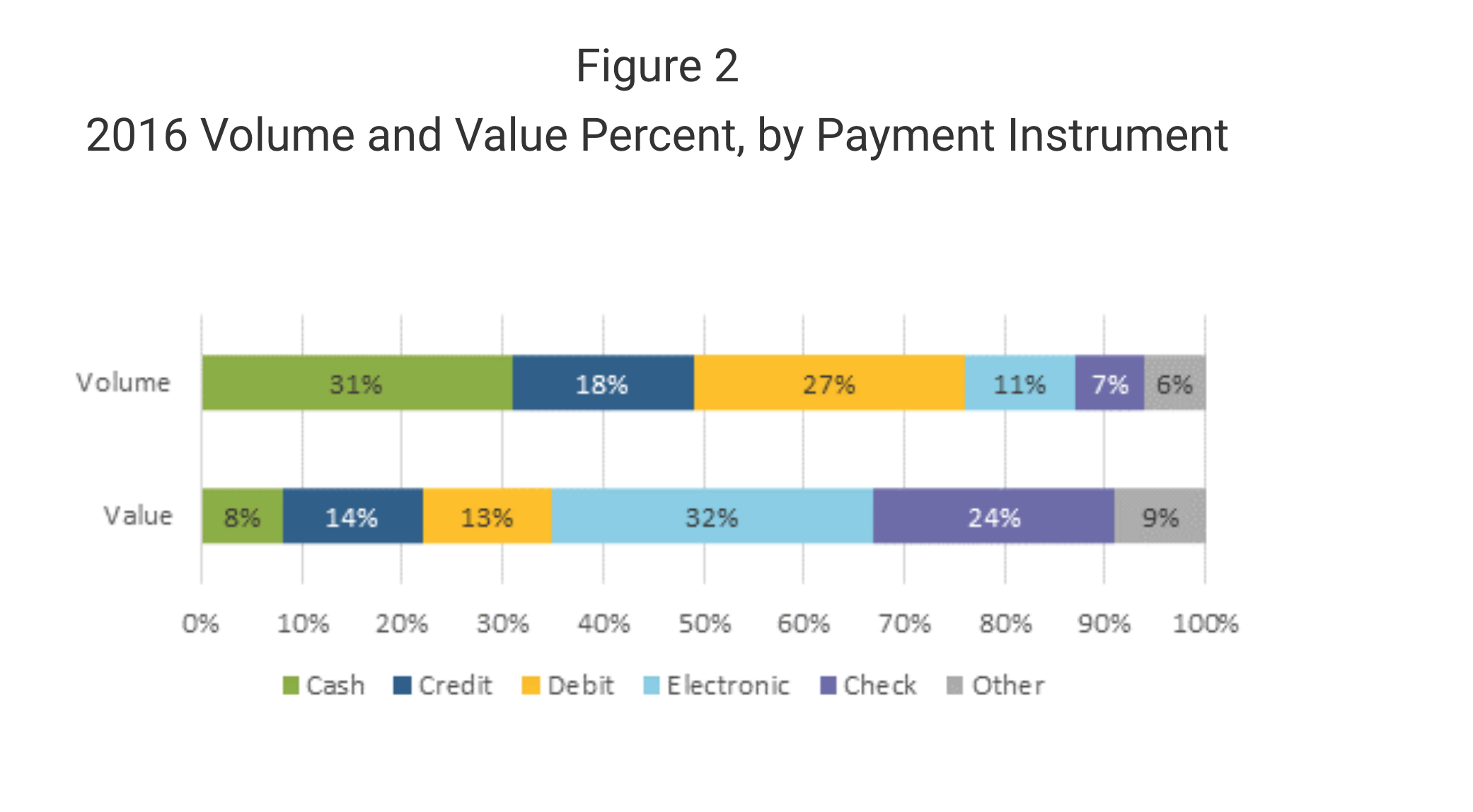

As in prior years, results from the DCPC indicate that by volume of transactions cash was the most used payment instrument in 2016, ahead of both debit and credit cards. Figure 2 shows the estimated aggregate volume and value shares of all payments (including bill payments and non-bill payments) from the 2016 DCPC.

This includes cash, check, credit cards, debit cards, other electronic payments made through bank accounts, and other payments. On average, DCPC participants reported making 46 transactions per month, and used cash to pay for 14 of those transactions (31 percent). Debit and credit made up 27 and 18 percent respectively.

Download 2017 Findings from the 3rd DCPC Survey here

Related Content