Findings from the 2nd Diary of Consumer Payment Choice (Federal Reserve, 2016)

The data gathered from the DCPC 2015 survey show that 'cash remains a unique, resilient, and heavily used consumer payment instrument'. The report follows the the first DCPC survey, conducted in 2012 with findings published in 2014. According to the report, cash was the most frequently used payment instrument and that is prevalent across all demographic groups.

Key findings include

- Cash continues to be the most frequently used consumer payment instrument

- Cash is widely used in a variety of circumstances

- Cash dominates small-value transactions

- The average value of cash holdings has grown

- In 2015, 32% of consumer transactions were made with cash, compared with 40% in 2012.

Excerpt from the Federal Reserve 2016 Findings report

The 2015 results also show that cash is facing competition from other payment instruments. In 2015, 32% of consumer transactions were made with cash, compared with 40% in 2012. Growing consumer comfort with payment cards and the growth of online commerce, among other factors, contribute to this trend. Nonetheless, a broad range of results suggests that cash remains resilient and continues to play a key and unique role for consumers.

Background: High-level trends suggest cash use is evolving

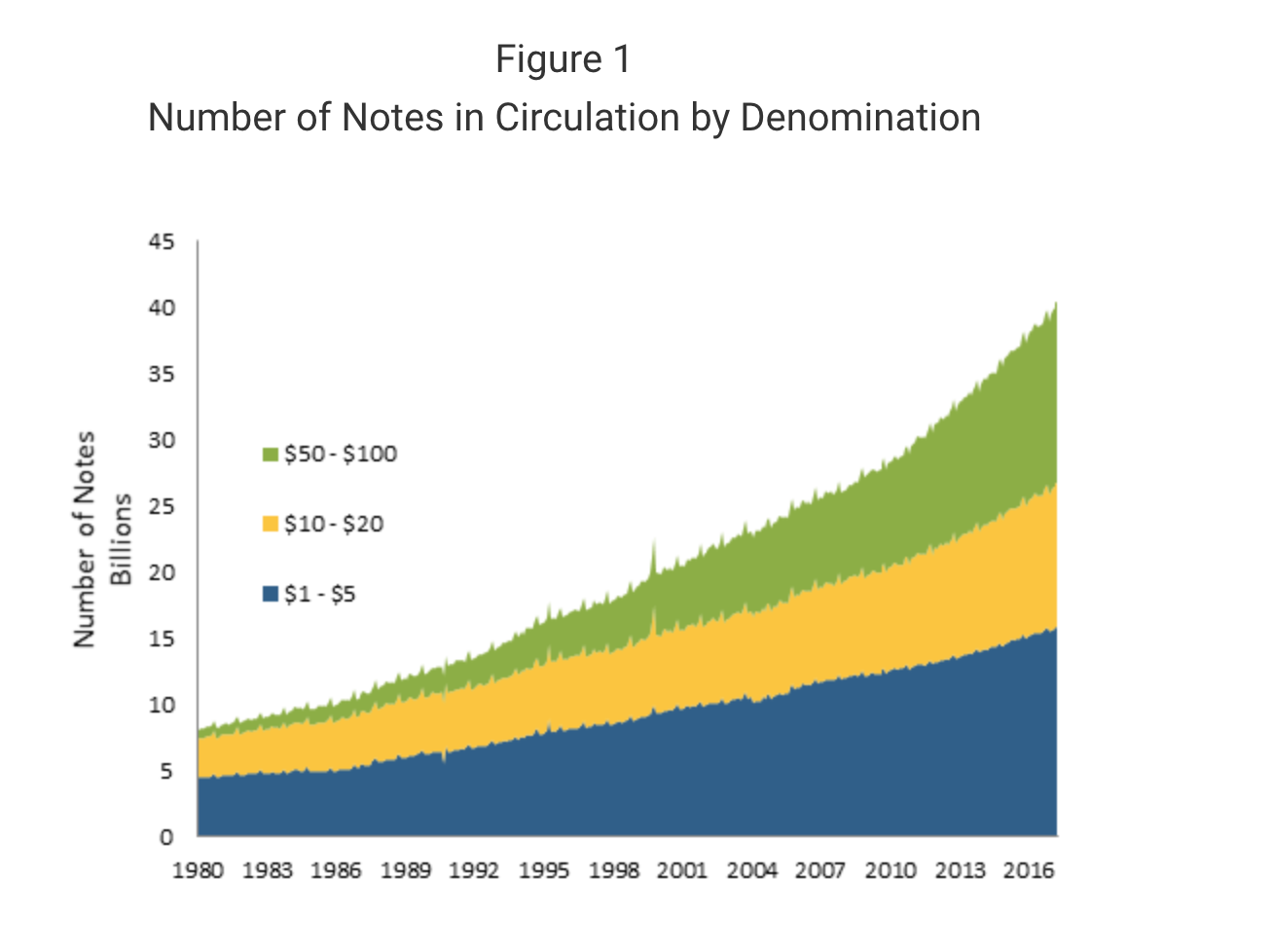

Despite innovations in smartphone technology and mobile payment apps, Fed data on the amount of currency in circulation suggest that demand for cash is strong. Figure 1 shows currency in circulation from January 1980 to August 2016 and includes notes held by merchants, financial institutions, and consumers.

The amount of currency in circulation has increased steadily over time, and demand for higher denominations has accelerated in the years since the 2008 financial crisis.

Finding 1: Cash is the most frequently used retail payment instrument

In 2015, cash remained the most frequently used retail payment instrument, used in nearly one-third (32%) of all transactions, including bill payments (Figure 3). Consumers used debit cards for 27% of their transactions, followed by credit cards for 21% of transactions. Electronic payments (e.g. ACH transfers and online bill pay) and checks comprised a small share of transaction volume, though the value of these payments tended to be higher than cash, debit, or credit payments.

Download 2016 Findings from the 2nd DCPC Survey here

Related Content