European consumer protection agency makes case for cash

The BEUC, the European umbrella consumer organization of national consumer protection agencies, presented this paper in response to the increase in cash restrictions across Europe accelerated by a decline of free ATMs. The paper argues that cash is necessary for protecting consumer privacy, financial inclusion, and resilience against energy outages and technological failures. Ultimately, cash exists for the public good: everyone should be able to access and use a resilient form of payment alongside electricity-dependent payments. After all, keeping cash contributes to a more competitive (and fairer) retail payments market by preventing market domination by a few commercial payment card companies.

'A cashless society would mean full dominance of the commercial sector in the payments market, since cash is the only public currency issued by the authorities.'

Some of the group's members—including the United Kingdom's consumer charity, Which? and Sweden's pro-privacy group, Sveriges Konsumenter—have already called for nation-wide action to protect cash. Now, BEUC is making a case for actively protecting cash at the EU-level with the help of four key recommendations presented within the 18-page paper:

- The EU should ensure that there is a minimum availability and balanced geographical distribution of ATMs within each Member State across the EU.

- The EU should ensure that consumer access to cash is free of charge, at least when using the ATM network of their bank. Plus, consumers should have the right to make several free of charge withdrawals/month at other ATMs. Countries, where ATM fees are currently prohibited, should maintain the prohibition.

- The EU should ensure that ‘cash withdrawal in shop’ is promoted, as a complementary option to the use of ATMs.

- The European Central Bank should give a high priority to access to cash.

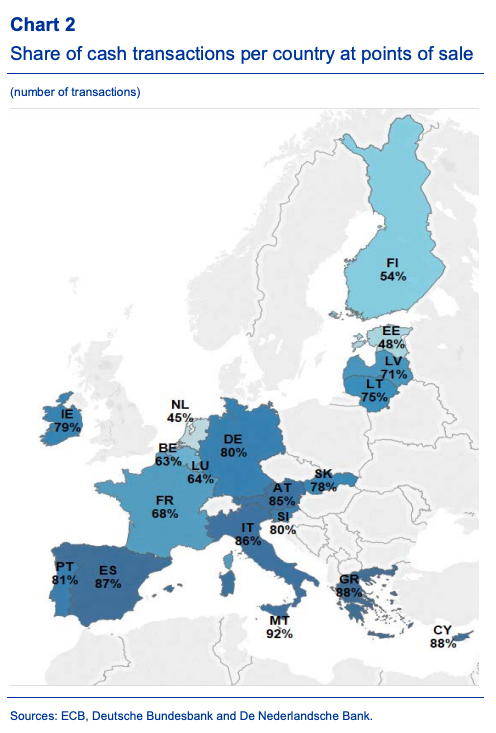

'Despite an increase in the use of electronic payments, in several EU countries cash remains the most used payment instrument at Point of Interaction. Consumers should have a choice of payment methods...'

Consumers should have the right to choose how they pay. Each payment method has its advantages depending on the consumer’s needs and preferences. Cash has several features that cannot be matched by electronic payment services: it guarantees the consumer’s privacy. It also ensures the financial inclusion of people who don’t have a bank account. And it is independent of energy outages or information technology failures. Finally, it contributes to a more competitive retail payments market by preventing market domination by a few payment card companies. Cash needs protecting (p. 1).

According to the paper, one of the fundamental problems related to the cashless society is digital and social exclusion. Cashless does not just mean using a card and a code to pay in a shop. More and more transactions require the use of sophisticated smartphones and applications which, themselves, require a level of tech savvy before making payments. It is also clear that the fast development towards a cash free society will affect many vulnerable consumers. For example, Sveriges Konsumenter is opposed to a cashless society considering that it will negatively affect many vulnerable consumers and proposes a series of political solutions to deal with these growing problems (p. 13).

Finally, the paper sheds some light on the debate around the comparative costs of various means of payment and discusses who would truly benefit from a cashless world.

A cashless society would mean complete loss of personal privacy, since a cashless society is a fully traceable society.

Automated Teller Machines (ATM) are the easiest means for consumers to get cash. To prevent consumers from lining up at the bank branch to withdraw their money, banks invented ATMs forty years ago. Nowadays, most consumers access cash through ATMs.

However, consumers increasingly face difficulties in accessing their cash through ATMs and bank branches. Bank branch networks are being cut in several countries, and sometimes there are no cash services provided. Moreover, more and more banks and ATM providers across the EU impose fees for cash withdrawals. In some EU countries, cash is no longer accepted in shops. This raises the question of legal tender which is not defined at the EU level even within the eurozone (p. 7).