Colorado Champions Cash Choice

New legislation in Colorado makes it the latest state to protect payment choice by requiring retailers to accept cash.

After a constituent contacted Colorado State Representative Alex Valdez in spring of 2020 to complain their local businesses were refusing cash payments, Valdez began seeing cashless businesses everywhere, from restaurants to his local coffee shop. It’s a story that mirrors the experiences that drove U.S. Representative Ritchie Torres to champion the right to pay cash in New York City, and has similarly led to a bill requiring businesses to accept cash.

HB21-1048 Retail Businesses Must Accept Cash states that U.S. currency has to be taken in exchange for goods and services, with violation being a class 2 petty offence punishable with a fine of up to $500. Its prime sponsors were Rep. Valdez and Senator Robert Rodriguez.

PEW Charitable Trusts, a non-profit NGO that aims to improve public policy, observes that providers of cashless payment options, such as credit card companies, receive a fee every time a customer uses their product, which has led them to encourage businesses to stop taking cash.

The number of businesses taking a cashless stance has clearly risen with the pandemic, however a recent survey by payment processing service Square found 85 percent of sellers who accept cash do not have any plans to stop doing so. ‘When do small business owners predict the U.S. will be a cashless society? Survey says: never.’

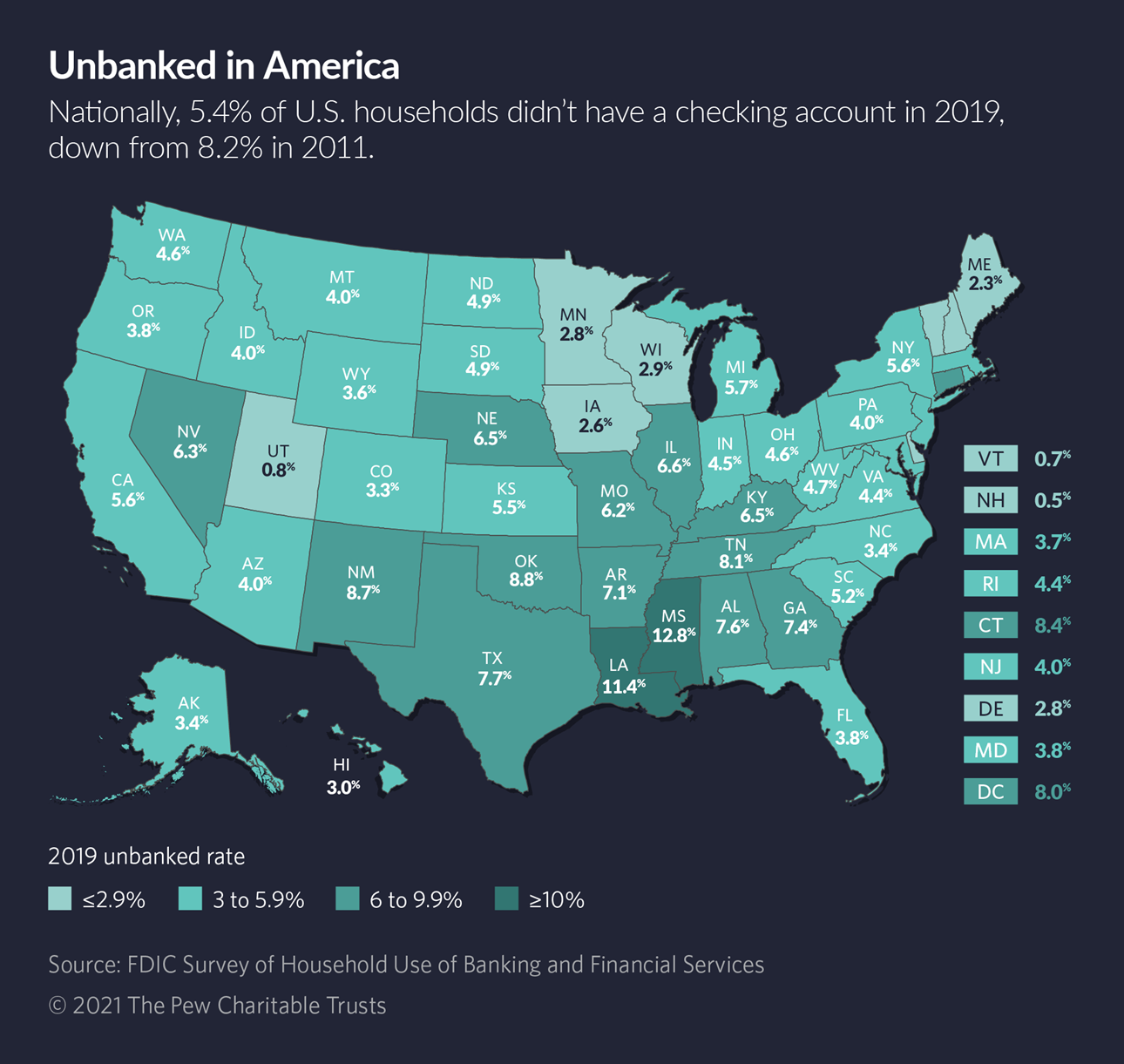

Alongside the security offered by cash, and the importance of preserving everyone’s right to pay in the manner of their choosing, there is also concern that cashless policies will discriminate against people who lack bank accounts and thus access to non-cash options. Diane Standaert, Senior Vice President for Policy and Advocacy at HOPE, a Mississippi-based credit union and development organisation, notes that more than one in five Black Mississippians do not have a bank account, saying ‘we see exactly who would be excluded by any move to go cashless.’

Moving to cashless transactions would be quite exclusionary to already economically vulnerable populations.

PEW observes there has been surprise among lawmakers who have sponsored cash-friendly legislation that there isn’t currently a federal requirement for businesses to accept legal tender. Valdez says he never knew bills would be required at the state level, having assumed the federal government would have cash covered. Overall, he concludes, the new bill is favourable for everyone, including businesses.

The truth is, this is better for merchants anyway, because they don’t have to pay processing fees and the like.