Climbing Costs Driving Cash Comeback

Cash is seeing a comeback in America and Britain as people seek finer control of their finances in a challenging economic environment. Bloomberg recently explored the trend, and how banknotes and coins enable better money management.

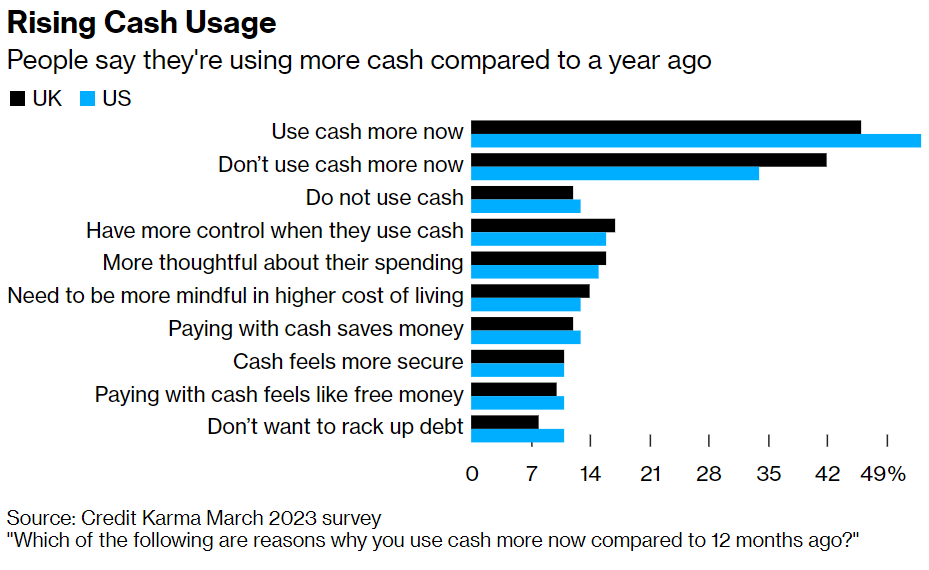

A survey conducted by The Harris Poll on behalf of personal finance company Credit Karma shows 53 percent of adults in the US and 46 percent in the UK are using more cash this year than they did last year. For comparison, 27 percent of US adults and 42 percent of Brits said they were not using more. Around three in five cash users in both countries believe using cash helps them spend less.

Bloomberg suggests this change in payment behaviour may be ‘a reaction to the proliferation of digital ways of paying… that some consumers say make it too easy to blow through the budget.’ More than two-thirds of survey respondents believe cashless options make them spend more than they intend.

Younger generations are discovering cash via the ‘cash stuffing’ trend that has been rising in prominence on social media since 2021. A person’s earnings are separated into different envelopes that cover essential expenses, and once these are full, further envelopes such as savings and luxuries can have cash placed in them. Presented as a hot financial hack, the technique is very familiar to older generations who are well acquainted with cash-based budgeting. Bloomberg adds ‘consumers are also taking to social media to push back against businesses that don’t accept cash.’

As the world is getting back to normal after the pandemic and prices are going up significantly, we see cash as being one of the most enduring ways of managing money. It really transcends generations and financial situations.

In addition to the physical nature of cash making it easy to see how much is allotted to different outgoings—and how much remains once they have been covered—the ‘pain’ of parting with cash is also a well-researched phenomenon that makes people less prone to frivolous spending when using banknotes and coins versus cashless options.

A lot of the theory on payments has been to remove friction. Actually, a lot of people want friction back. One of the reasons [for overspending when paying cashless] is people are more likely to just tap and buy things without thinking, ‘Gosh, that’s a lot of money.’

Social media is filled with personal accounts of successful cash-based budgeting. Bloomberg cites Brit Emily O’Donnell who switched to cash-only spending in November, inspired by TikTok videos, and has since ‘cleared off £7,000 ($8,740) of debt and started saving for a house deposit.’ In the US, entrepreneur Jasmine Taylor used her $1,200 stimulus money to start a business based on cash stuffing and financial management, which is on track to bring in $1 million in 2023.

While not everyone might expect such dramatic results, for those finding it difficult to keep track of their spending, switching to cash is an easy and proven ‘financial hack’ to implement.