The Cashless Economy Myth

A recent article in Middle East Business Intelligence explores a central myth of imagined cashless economies: that cash and digital payments are mutually exclusive options, with countries needing to choose one or the other. In reality, cash and digital payments are complementary and being used for different purposes.

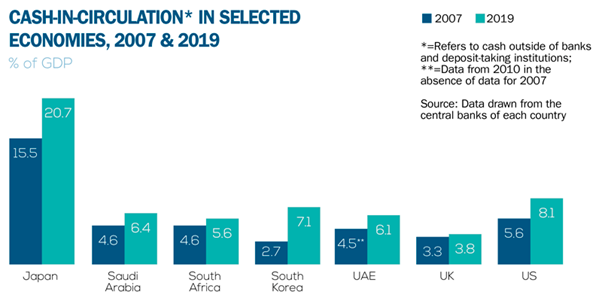

In early 2020, the United Arab Emirates launched a new mobile payments platform with the hashtag #CashIsCancelled, and yet cash in circulation continues to rise year-on-year, both in UAE and around the world. Within the wider Gulf Cooperation Council (GCC) countries, the payments industry persists in proclaiming an increase in digital payments must come at the expense of cash, but in fact this rise is happening alongside a parallel increase in cash.

Source: Middle East Business Intelligence

Despite these efforts to go cashless, the share of cash payments at point-of-sale in the UAE is 67 percent. This is because, in addition to being a valued and convenient payment option, cash is also a store of value for savings and lending. With an estimated 32 percent of UAE’s population unbanked—amounting to 1.7 million people—it is especially difficult to transfer the diverse benefits and uses of cash to digital channels.

In 2019, foreign workers in the UAE remitted around $45 billion to their home countries—the equivalent of 11 percent of the UAE’s GDP—and given the absence of digital money transfer solutions along these popular remittance corridors, it is unsurprising that cash is vital for this segment of the population.

From 2015, when the price of oil started a downward trajectory, credit conditions became increasingly challenging for small and medium businesses in GCC countries. Those organisations that find themselves unable to secure bank credit—or those for whom peer financing is simply preferable—turn to informal lending arrangements, with one in four adults in the GCC saying they have borrowed informally.

Cash continues to be a central part of the payments landscape, both for lending and repayment arrangements and for everyday life where many people choose it over other payment options.