Cash thrives in Asia-Pacific, finds PYMNTS Global Cash Index™

The latest Global Cash Index™ by PYMNTS finds that across the Asia-Pacific region, cash is still king.

The report looks at cash use and cash share within 40 countries across the Asia Pacific region. The report focuses on Australia, China, India, Japan, South Korea and Singapore, noting that they are home to a massive portion of the world's undebanked population. A population that relies on cash out of necessity.

Beyond this, the cash culture that dominates these countries reveals that despite the range of circumstances and government--driven cashless initiatives, old habits are heard to break, especially when it comes to money. Cash thrives.

In India, there are 14 bank branches per 100,000 people and even after Prime Minister Modi's controversial demonetisation policy in 2016, up to 90% of all transactions within India's borders are cash-based. This could be heavily driven by the entrenched preference amongst India's merchants who refuse to accept any other method of payment.

“An overwhelming part of the Indian economy is cash-based [...] This cannot be changed in a couple years.”

In China, a substantial segment of the population living in rural areas continue to rely exclusively on paper notes and coins out of necessity because they are unfamiliar with or unable to access the internet. Even with the use of WeChat Pay and Alipay amongst China's young professionals is booming in urban areas,

'...careful inspection of China’s ATM and over-thecounter (OTC) cash withdrawals reveals that cash is still a hot item within its borders. In fact, ATM withdrawals in the country’s mainland have actually increased in volume in recent years.'

On the other end of the scale, the report finds Japan, South Korea, Australia and Singapore are on their way toward their own demonetizations. Still, this doesn't mean the public is ready to give up cash. In fact, they're not even close.

Singapore's government launched initiatives to develop a common QR code for digital payments, similar to China's trending methods. Yet, the push backfired and the wide range of e-payments overwhelmed merchants who would rather stick to cash until there is a single e-payment system worth committing time and money to.

Despite the availability of electronic payment technology, Singaporeans’ commitment to cash persists with an overall cash share of 15.1%. Once again, culture’s role in local economic development cannot be overlooked.

Japan's aversion to credit cards have not stopped its users from embrasing mobile wallets. Interestingly, this might be thanks to Japanese-developed electronic systems based on prepaid accounts, which like cash, prevents overspending.

This phenomenon provides a notable demonstration of how local circumstances can shape both consumer demand and the technology designed to meet that demand.

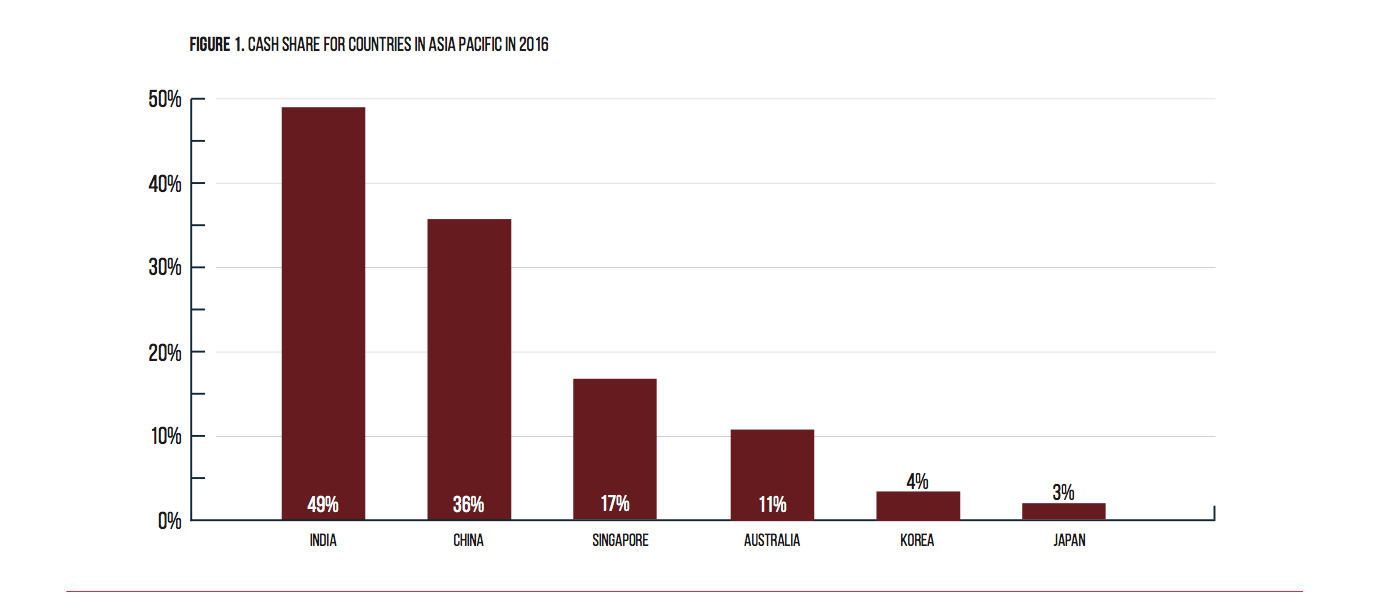

We define “cash share of the wallet” as the amount of cash withdrawn in a country as a share of its annual GDP. This allows us to determine the popularity of physical cash exchange in comparison to that of alternative payment methods. Figure 1 shows the 2016 cash share statistic for selected countries in the Asia Pacifc region.

This digitization movement has not been entirely organic either, and some national governments have undertaken rash methods to achieve demonetization.

The Indian government implemented an aggressive demonetization policy in 2016, with Prime Minister Narendra Modi announcing on Nov. 8 that 86% of the country’s rupee notes would cease to be legal tender. The highly controversial move threw a wrench in day-to-day operations of businesses big and small, and created unprecedented scarcity of cash in a country which has long adored cash.

To put it mildly, India’s push to go cashless has so far fallen short of its goal. Part of the reason, according to Hugo Erken and Wim Boonstra, senior economists at Netherlands-based financial services firm Rabobank, is that the government did not lay the proper groundwork for the transition to digital currency before implementing the cash ban.

With or without the government’s demonetization policy, it appears India’s grip on cash remains as strong as ever.

About the report

The Global Cash Index™ assesses the importance of cash in some of the largest economies in the Asia Pacific region, examining each economy’s reliance on cash according to the amount withdrawn at ATMs, cashback and points of sale.

The report distinguishes between two measurements of tangible legal tender: cash use and cash share. Cash use refers to the total number of transactions made with cash. Cash share refers to the total transactions made with cash as a percentage of GDP. The PYMNTS research team examined the political-economic circumstances governing select Asia Pacific nations’ drives toward demonetization. In doing so, we hope to demonstrate that effective commercial engagement with merchants and consumers requires an understanding of — and deference to — local attitudes and consumer demands