Cash Matters in New Zealand

An issues paper from the Reserve Bank of New Zealand explores why cash matters—from its place in rites at weddings and funerals to its wider role in supporting an equal society. The Bank also looked at its own responsibility to ensure physical money is available as ‘an anchor for the monetary system’ and ‘a fair and equal way to pay and save’.

The Future of Money – Stewardship paper explains central bank money, banknotes and coins, serves two essential functions: it contributes to financial and social inclusion, and provides a value anchor for the monetary system. It enables people and businesses to transact and reward each other, and is an irreplaceable payment method for those whom banks ‘refuse to accept as customers.’

Source: The Future of Money – Stewardship, Reserve Bank of New Zealand

The report notes that—as of 2019—13 percent of all household payments were made using cash. The highest cash users were those on government benefits, who made 31 percent of their payments in cash, and those receiving NZ Superannuation pensions, who used cash for 22 percent of payments. Overall, the report suggests that up to six percent of New Zealanders are entirely or heavily reliant on cash.

Cash provides another economic service beyond being a way to pay. It is available as an asset that has a certain nominal value, is free of credit risk and can be drawn on whenever the need arises.

The report also highlights the important cultural and social roles of cash, saying it is central to many cultural and social activities—ranging from how people participate in weddings and funerals to how parents interact with their children—and these uses of physical money ‘build a sense of community’. It observes there is ‘a high value placed on cash’ even by non-cash users since it benefits others.

By contributing to financial and social inclusion, cash helps develop and maintain New Zealand’s ‘social capital’, and the development of social capital benefits everyone.

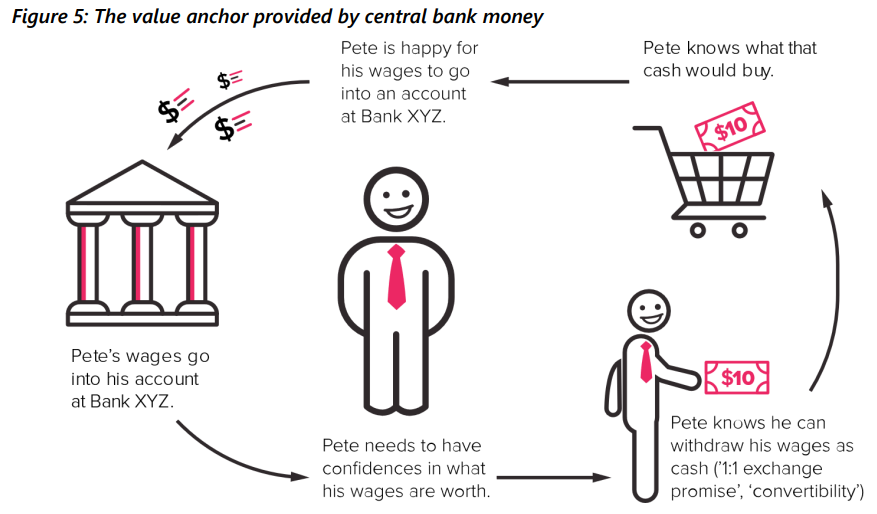

As an anchor of the economy, the paper explains cash ‘underpins trust and confidence in private money and therefore enables people to transact with confidence’. People ‘understand and trust its value’ and can quickly and easily exchange cash whenever they want, for 1:1 value—a benefit known as ‘convertability’—and these traits ‘underpin all financial transactions denominated in New Zealand dollars’.

Source: The Future of Money – Stewardship, Reserve Bank of New Zealand

The ability to convert money held digitally in bank accounts into cash is especially important during times of crisis, the report says, as demonstrated by ‘the significant increases in cash withdrawals at the beginning of the COVID-19 pandemic and by the rush of people to withdraw cash from stressed banks during the Global Financial Crisis that occurred in 2007–2008’.

In conclusion, the paper invited feedback on the future of New Zealand’s cash and the Reserve Bank’s management of related services, which closed in December. Its next step will be to prepare a summary of responses and outline its planned response, to be published by 30 April this year.