Cash in circulation continues to grow by 5% annually

Good morning, journalists, financial strategists and curious cash cats of the world. Time to wake up and smell the truthful aroma of a fresh report by Currency Research titled, 'The Case for Cash, Part One: Myths Dispelled'.

This report re-examines 16 myths the common debates about cashin order to 'ensure central banks and governments have a foundation of sound research and public policy on which to base their payment strategies'.

'Examining the statistics worldwide on cash issuance and usage, one concludes that while [...] the rate of growth in cash (not cash itself) may be declining in some countries, cash overall continues to grow worldwide between 5% and 8% per year.'

To offer a better understanding, the report looks closely at data from the European Central Bank, the US Federal Reserve, the Bank of England and the Reserve Bank of Australia as well as China, Turkey and Indonesia which 'echoed the upward march of currency' thus supporting the happy conclusion.

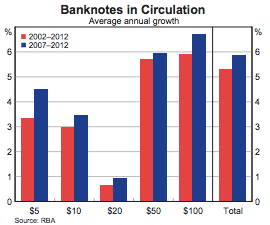

Australia

According to the RBA's latest report on banknotes, Australian cash in circulation was growing at 5% per annum in 2012 with a long-term growth rate expectancy of 6% but has since surpassed expectations with an increase to 7% in 2015-2016. Crikey!

Screenshot of RBA Table: "Banknotes in Circulation": Volume" (Reserve Bank of Australia, 2012)

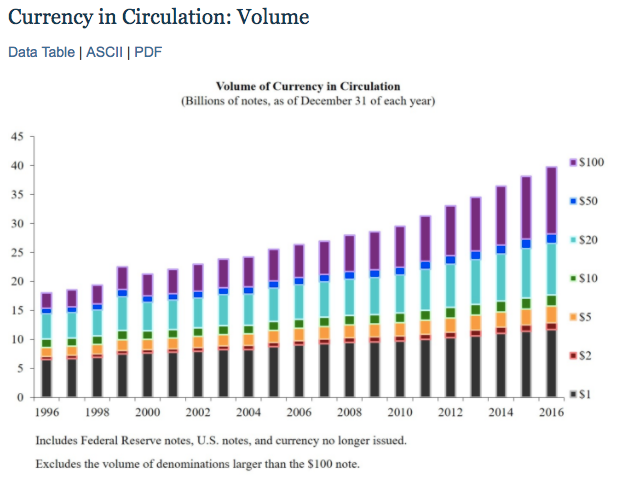

The United States of America

A mere two years later in the USA, the Federal Reserve predicted a continuing 'overall increase in the volume of currency in circulation'. And wouldn't you believe it? This expectation was also met as can be seen in the following table, which indicates non-stop growth of total banknotes in circulation from 2000 to 2017.

Screenshot of USA "Currency in Circulation: Volume" (Federal Reserve System, Aug 2017)

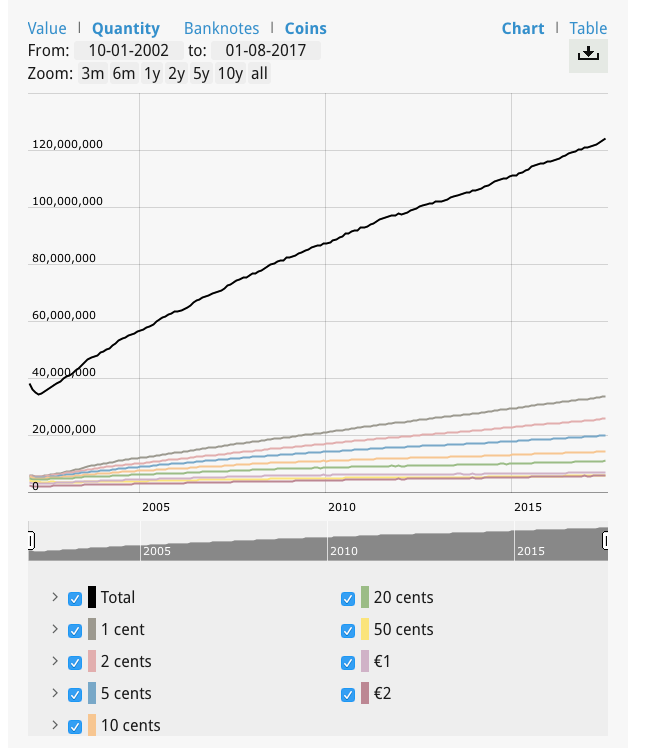

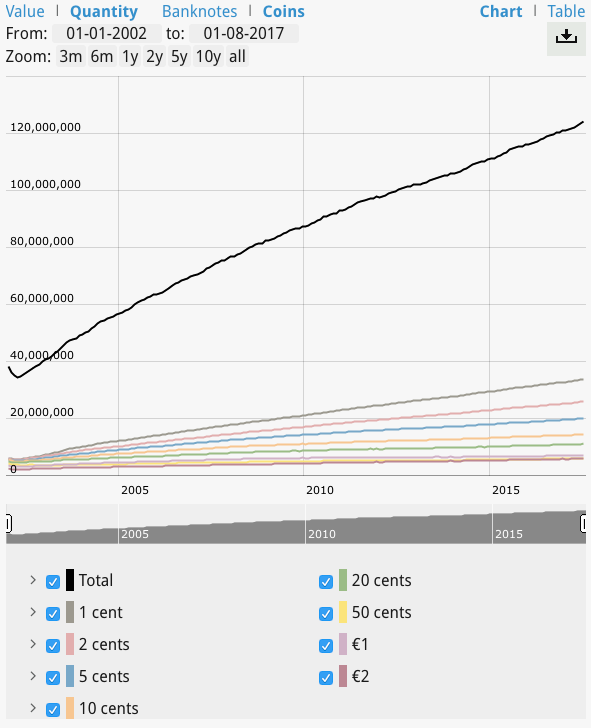

Euro Area

Similarly, the European Central Bank's data on the quantity of both banknotes and coins in circulation from early-2000s to 2016 show an upward trend. It appears that the transition to the Euro in 1999, the Brexit reverberations and the recent European Union proposal to cap cash payments have not caused a drop in people's undeniable demand for cash.

Screenshot of 'Quantity of Banknotes in Circulation: From 01-01-2002 to 01-08-2017' (European Central Bank, Aug 2017)

Screenshot of 'Quantity of Coins in Circulation: From 01-01-2002 to 01-08-2017' (European Central Bank, Aug 2017)

The United Kingdom

Likewise, the United Kingdom has also seen a positive trend in cash production. In fact, the Bank of England's website published figures that 'clearly demonstrate that every indicator is up'.

Bottom line

Despite geographic variations, global demand for cash continues to thrive.

Source:

Currency Research. "Case for Cash Summary Report." Currency Research, 2014. Accessed July 20, 2017.