Earlier this month the annual survey of UK payment markets was published by UK Finance. For payment industry nerds it’s the not to be missed publication of the year, presenting a wealth of data and analysis on payment trends for the previous year and forecasts for the next decade. It’s a world-leading publication, combining industry data with an in-depth qualitative payments diary study that’s been running since the late 1980s, providing us with a robust and unparalleled view into the use of payments in the UK.

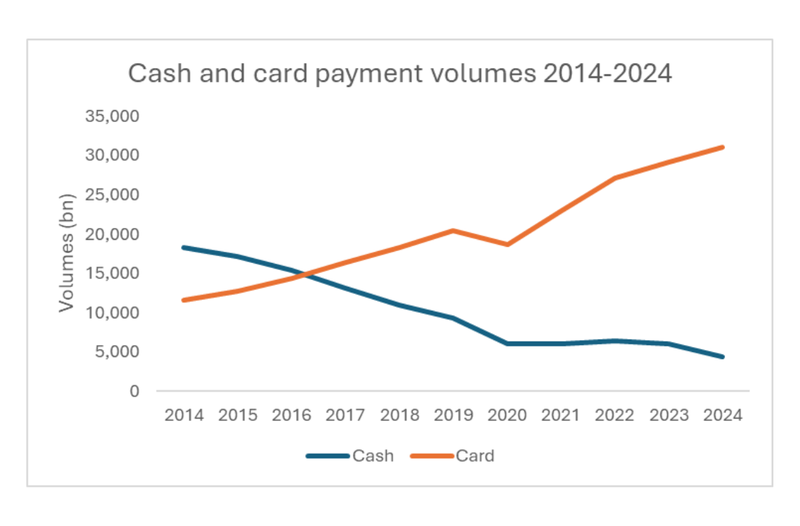

For those with an interest in the performance of cash the publication presents the annual confirmation that cash is being used less than it was the previous year. As the chart below demonstrates, this has been the case for several years as different variations of card payment (chip and pin, contactless, mobile) have become increasingly popular for low-value, everyday payments.

What does the latest report tell us about cash?

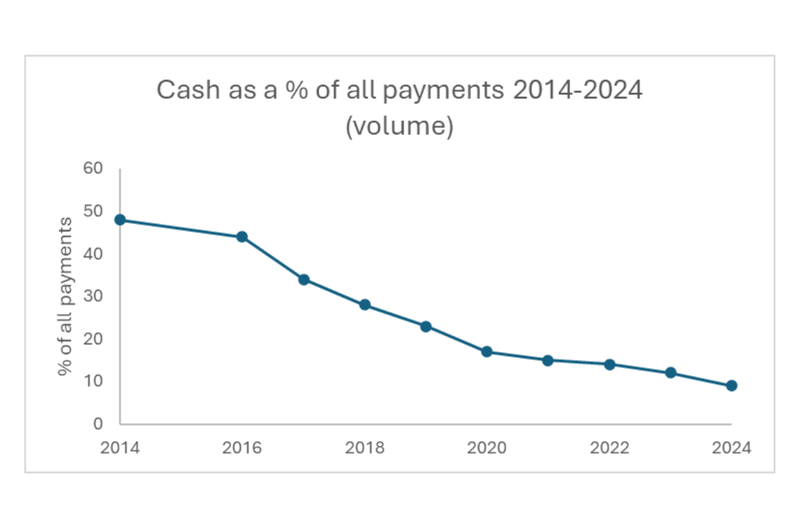

The headline finding from this year’s report informs us that in 2024 cash payments accounted for 4.4 billion payments, 9% of the total volume. It notes that cash payments have been declining over the past two decades (see chart below) and 2024 marks a new threshold as cash for the first time amounted for less than 10% of all payments ending its role as the second most used payment method in the UK, falling behind Direct Debits, Faster Payments and credit cards.

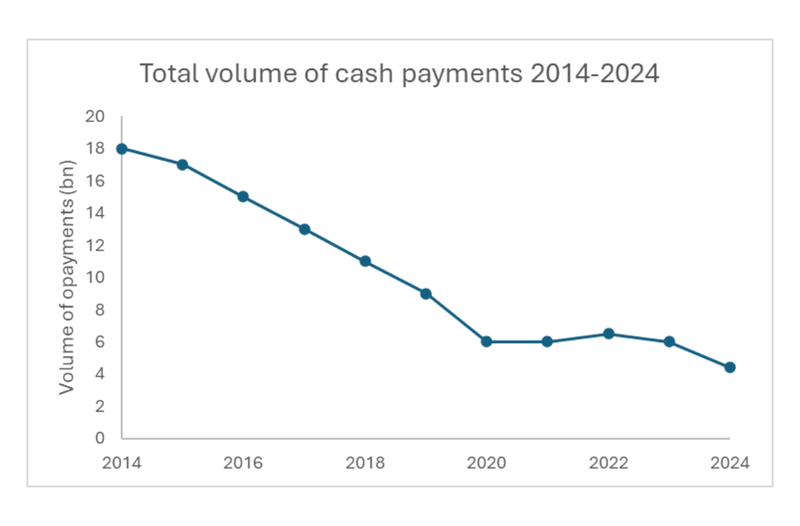

This is what one would expect. Last year, the report found that cash accounted for 12% of all payments and has been below the 20% mark since 2020. As the chart below shows, the total number of cash payments has also declined over the past decade, despite a small increase between 2020-2022, which is likely due to a combination of the pandemic and cost of living crisis, where people may have used cash to manage their household budgets.

So, while these main findings are informative, they don’t tell us anything that we didn’t already know, that is, ‘cash is being used less, digital payments are being used more, and there’s a small segment of society that’s wedded to cash’. As the report states, digital payments aren’t for everyone, and “for some the use of cash continues to be an important element of how they manage their finances.” However, if we look at the report in more detail, there are some insights that paint a fuller picture about the role of cash in 2024.

- More people used an ATM than the previous year

While cash transactions declined, cash machines played a bigger role in cash acquisition as 49.4 million people used one, up from 46.3m last year. ATMs are by far the most popular form of cash acquisition in the UK, and it’s quite a feat that around 1-in-7 of UK adults used one in 2024 when cash accounted for less than 1-in-10 of payments. On the surface, these look like contradictory statements, but it points to the reality that while cash is being used less for day-to-day payments most UK adults continue to have a varying degree of contact with cash.

- Fewer people are living cashless lives

The report found that while almost a third of adults in the UK were living largely cashless lives in 2024, defined as using cash once a month or less frequently, this is significantly fewer when compared with prior years. In 2024, 16.9 million people fell under this category, a fall from 22.1million the previous year. There is no obvious explanation for this, possibly a return to some sort of budgeting, or even something as small as after school clubs requiring cash contributions, but it could be a reason for the increase in ATM use.

- There’s a segment of society who mainly use cash

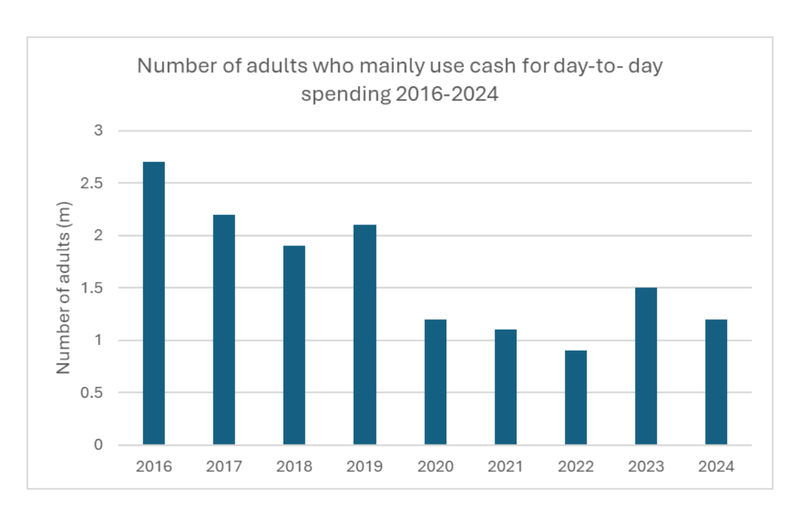

The survey also provides a number for people who mainly use cash for day-to-day spending and rarely use a digital alternative. In 2024, this accounted for 2.1% of the adult population, or 1.2 million people. As the chart below shows, this has fallen from 2.7 million in 2016 but has increased from 0.9 million in 2022. The increase seen in 2023 is likely due to budget management during the height of the cost-of-living crisis.

Cash is still popular for person-to-person payments

When we look at how cash is used for ‘spontaneous payments’, “those items of spending that an individual is not committed in advance to making each month”, the report finds that cash accounted for 13% of the volume of retail spending, 10% of entertainment and 8% of travel. It remains strong for the use of person-to-person payments, accounting for 19% of the total volume, however this category only accounts for 2% of all spontaneous payments.

These details paint a different picture of cash use. Yes, it’s being used less than the previous year, but despite this it remains an important feature of the payments landscape, and its decline is not even. The high use of cash machines and increased use of cash by those who previously considered themselves mostly cashless, points to a more colourful role than the headline findings suggest. The headline "cash is only 9% of payments" obscures a more nuanced reality where cash remains embedded in UK life.

What else we know about the role of cash

It has been my view for some time that while these insights are important, they do little to improve our knowledge of the use of cash. If cash use will continue to decline, albeit at a slower rate than in previous years, why are so many people using cash machines? Why has there been so much effort to secure its existence (such as the Access to Cash Review, new regulation)? And what does 9% of payments mean in the reality of day-to-day spending? How does this square with the increasing value of bank notes in circulation, which increased from £82.3bn to £85.9bn from 2024-2025?

The last question is commonly known as the cash conundrum and points to the paradox that is seen in almost every developed economy, the notable exception being Sweden, which has seen a fall in cash being used for payments and a fall in total cash in circulation. The continued rise in cash in circulation is attributed to cash being saved or hoarded as a store of value, either domestically or overseas, as well as being used under the radar – not always for illegal purposes.

It’s also necessary to have more cash in circulation than is being used for spending to ensure that ATMs and tills are full while cash is being sorted and verified in cash centres and transported around the country. This is difficult to explain in the context of payments as it’s not the usual behaviour of a modern payment method. It wouldn’t happen with cards. But this is the point: cash is not like other payment methods, and that’s why it can’t be compared like for like with its contemporaries. This is why when you try to settle on a number for ‘overall cash use’, you are left with unanswered questions.

As outlined above, looking beyond the headline figure can provide more detailed insights. Research from LINK found that in July 2025 almost seven-in-ten (69%) of the adult population said they used cash to pay for something in the past two weeks. Looking at the responses to this question over time, they found that this has been between 69%-73% since February 2022. This suggests that despite overall cash spending falling, regular use for everyday in-person transactions remains stable. They also found that 27% of people spent cash in supermarket, and 26% in a convenience store, in the past two weeks, providing more colour to the overall cash use figures recorded in the UK Finance paper.

There’s also a strong emotional attachment to cash and a sense that it will come in handy in an emergency. LINK’s research found that while 75% of respondents said they can easily make all their day-to-day payments by phone or card (opposed to 11% who say they can’t), 89% said it’s important that cash remains an option as digital options may not work. 85% also highlighted the risk of a cashless society and the effect on people who cannot use digital payments yet. The same amount (85%) worry that a cashless society could exclude vulnerable groups, and 71% see cash as vital for personal freedom.

The future for cash

In terms of a forecast for cash use, UK Finance predict that while cash will continue to decline and account for 4% of all the volume of all payments (2.1bn) in 2034. As they state “the rate of decline has slowed as use becomes concentrated amongst people who have a strong preference for cash and in situations where cash has advantages over other payment methods. Over the next ten years, the decline is expected to be far smaller than that seen over the past decade.”

This forecast appears well-founded, and it puts the UK in line with other cash-lite countries. As I pointed out earlier this year, even in Sweden and Norway, two of the most ‘cashless’ countries in the world, cash remains a feature in their societies. In Sweden, data from the Riksbank shows that while 40% of people said that they paid cash for their last in-store purchase in 2010, this has been around 10% for the past three years; in Norway, the number of cash payments as a percentage of the total number of payments fell from 12% in 2017 to 3% in 2020, where it has remained without significant variation. While these are small numbers, they tell a big story: at some point, even in the most digitally advanced societies, cash stops declining, plateaus and finds a new normal.

There’s more than meets the eye from the headlines about cash. Regular research targeted to understand cash spending, combined with expert analysis and lessons from other countries, a more realistic view of the future of cash becomes clear. In an age when we’re witnessing greater digital involvement in our day-to-day life than ever before, it’s never been more important to understand the areas where analogue remains the preferred choice.

About the author:

David Fagleman is the Director and co-founder of Enryo Consulting. He is an internationally recognised expert on the cash and payments industry.

Note: The author of this article holds exclusive copyright and is solely responsible for all content and data presented herein.