British retailers object VAT cut, citing coronavirus myths

On 22nd June 2020, Former Chancellor Alistair Darling urged the UK government to “boost consumer spending by cutting the standard rate of VAT,” according to the [Retail Gazette]. This move has reportedly been met with criticism by retailers who have raised concerns that the cut could “result in extra cash-handling that could increase the spread of coronavirus."

Since re-opening their doors on 4th June 2020, Britons have rushed to the shops. However, many stores have increased their contactless spend limit to £45, indirectly addressing consumer fears surrounding the press-spread myth that cash is not safe. The World Health Organisation was misquoted back in March which has instigated consumer fears of the virus being transmitted through cash, therefore, favouring cashless transactions.

The latest brand that has been accused of exploiting this myth is European fashion giant Primark. The brand, which has 188 stores in the UK alone, has reportedly objected to the VAT cut due to similar experiences in Germany which led to an increase in cash transactions in their stores.

"They said that since VAT had been cut in Germany, staff at its 27 stores there had reported an increase in the amount of cash they handled because prices were no longer in round numbers."

Primark's real problem

Primark is one of the most popular clothing retailers in the UK, boasting [7.1% market share]. Despite its popularity, it is one of few high street shops that do not sell online, leading to a completely profitless period for the brand during the nation’s first three months of lockdown. It’s estimated that Primark took a nosedive in revenues during this period, with the temporary store closures costing [“about £650 million.”]

The popularity of Primark is thanks to its low-cost fast fashion. It competes with other European giants like H&M by creating lower-cost versions of the similar staple items. In [2015, it was revealed] that the average selling price at H&M was £10.69, whereas the average selling price at Primark was £3.87. With the average value of a [cash payment in 2019 totalling £10.21], Primark will undoubtedly process more cash transactions than their competitors.

The brand may have focused on the redundant argument of the transmission of the virus through cash to oppose the VAT cut, however, the Retail Gazette has highlighted an alternative reason for the backlash:

"The cuts will likely create more administrative costs for businesses, at a time when retailers are already discounting heavily to persuade shoppers to make purchases."

The Cost of Cash

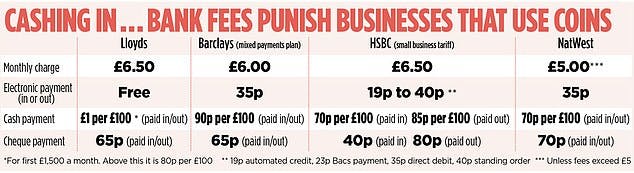

For retailers, the cost of cash transactions in the UK is high in comparison to card transactions. In 2019, both HSBC and Lloyds banks hiked up their cash charges for retailers. The charges, which include monthly account fees and small processing costs per £100, are said to be influenced by the cost of processing cash for businesses in banks. Read more

For brands like Primark, it’s undeniable that the opportunity of cutting costs where possible would be an essential exercise at this time. It is, therefore, safe to assume that potential threats that could further threaten their revenues, which increased by 4% to £7.79 billion last year, would need to be addressed.

For other brands, the VAT cuts could offer a lifeline. In contrast to Primark’s success, the rest of the British high street had been crumbling long before the global pandemic. Going against Primark, the Retail Consortium is pushing for the VAT to be lowered in a bid to support brands and stores following added pressure during these uncertain times:

"A temporary reduction in the headline VAT rate […] would boost consumer demand and raise consumption."

Exploiting coronavirus fears to prevent lowering VAT, a move advised to protect the economy and, in turn, people’s jobs is as unjustified as it is reckless. Rather than manipulating consumer concerns in an attempt to cut costs on cash administration, Primark should recognise that the 2.1 million people in the UK who mainly pay with cash most likely already shop at their stores anyway, whether the number on the tag is rounded or not.