British Retail Consortium Encourages Cash Protection

In its 2020 Payment Survey, the British Retail Consortium notes that while transactions in cash have declined by more than 15 percent in five years, cash continues to be a highly valued payment option for consumers, enabling them to better budget and control their spending.

The BRC notes that cash remains a key feature of the payment landscape in the UK, accounting for well over a third of all retail transactions. A 2019 report by the Payment Systems Regulator backs this up, showing that 83 percent of consumers made a cash payment every week, and 28 percent preferred using cash to other options.

Access to cash is a concern raised by the BRC in its survey, and it welcomes the Government’s 2020 Budget pledge to introduce legislation that will protect cash going forward. It also highlights the increasingly important role played by retailers in realising that goal.

Retailers and the Post Office have been increasingly called upon to stand in for banks in recent years to provide financial services to customers abandoned by the widespread closure of bank branches and ATMs.

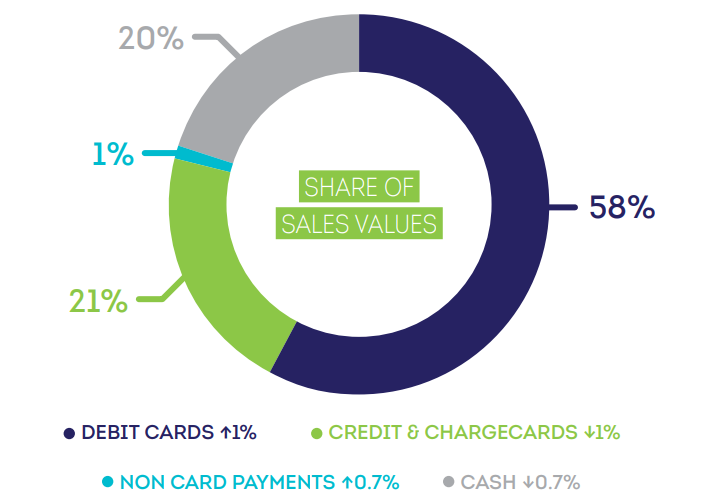

Cash was used to pay for £77.6 billion worth of goods in 2019—a share of just under 20 percent of total sales value—and the average cash transaction value has risen from £10.21 in 2018 to £12.50 in 2019.

Share of Retail Transactions, 2020 Payment Survey, British Retail Consortium

The BRC encourages retailers to support consumers’ access to cash, stressing the importance of appropriate remuneration for retailers providing these services and ultimately calling on the Government to do more to improve this remuneration.