How Australia's $10,000 cash ban would restrict civil liberties

On August 5th, 2019, economist John Adams warned that the cash-restricting law infringes on the public's liberties, punishing law-abiding Australians for how they wish to spend their hard earned money.

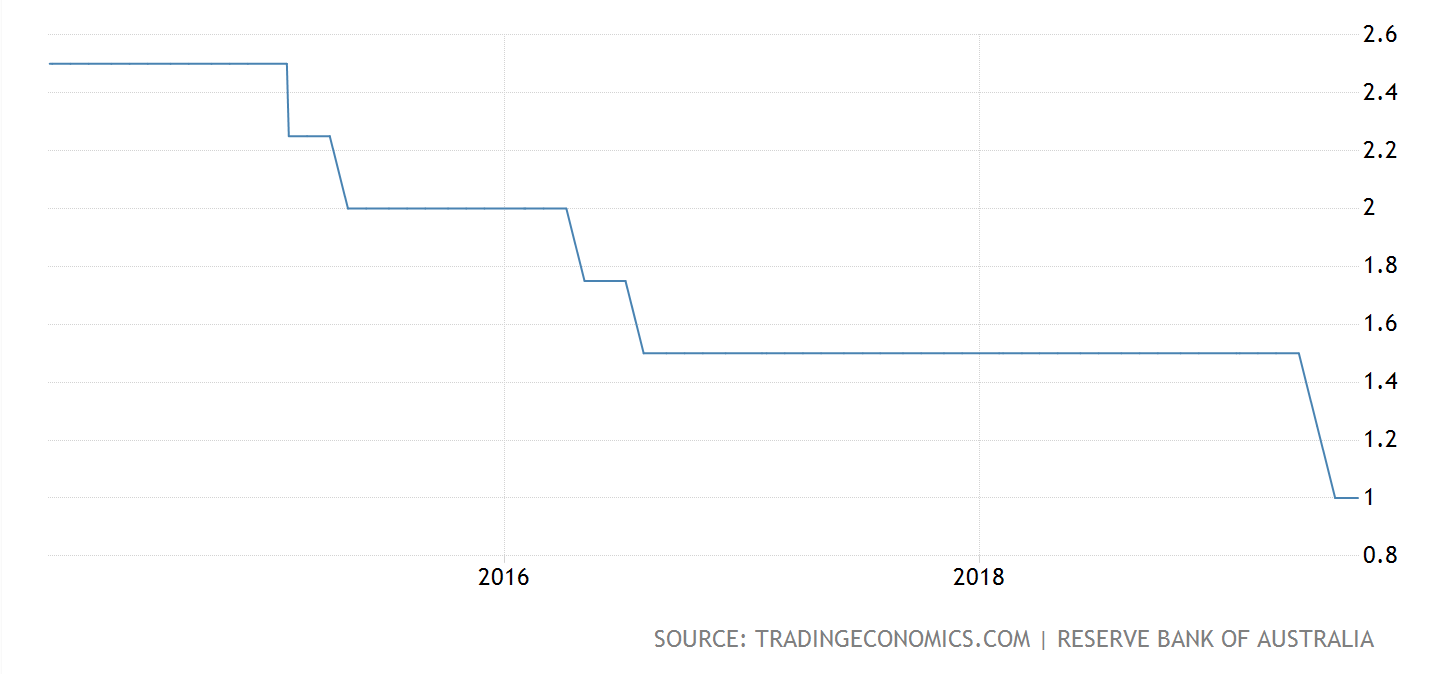

Adams points out that with Australia's already-low 1% interest rate, curbing cash use paves the way for the government to impose a negative interest rate at the first sign of a recession. Indeed, the International Monetary Fund recent paper, "Cashing In: How to Make Negative Interest Rates Work", appears to be more of a driving force than attempts at targeting crime.

RBA: Interest rates in Australia over the last five years

Why is this dangerous?

Critics see the law as the latest in a series of restrictions on cash use imposed by Australia's government. In 1992, the government eliminated the 1-cent and 2-cent coins from circulation. Last year, the Cashless Debit Card (CDC) program was extended, despite a lack of evidence that the program (in which adults on welfare are provided given government issued debit cards that can only be used for pre-approved goods) was effective. Critics of the CDC also argue that denying welfare recipients cash revokes a psychologically important sense of independence and inclusion at the point of sale.

“Communities have been through enough of this social experiment, which the government cannot claim is working.”

As the Federal Government moves to ban cash transactions above $10,000, there's a theory gaining traction that the real motive for the cash ban isn't the so-called "black economy", but rather, to give authorities greater control over your behavior during recessions.

This theory, put forward by economists such as John Adams — and picked up by some federal politicians — has not been plucked out of thin air.

It is based on repeated public papers and statements by the international body in charge of financial stability — the Washington-based International Monetary Fund (IMF).

“We are experiencing a period of major political shocks...Political shocks are turning into economic shocks.”

The government will push ahead with the expansion of its cashless welfare card trials, despite the auditor general finding it was unclear whether the program was actually reducing social harm.

An auditor general’s report published on Tuesday found it was “difficult” to evaluate the success or cost-effectiveness of the program, which aims to reduce alcohol and gambling-related harm by restricting the way welfare recipients can spend their money.

Read full Guardian article here

It is up to the public to stand up for cash each time it is threatened by power-hungry bodies. After all, cash is a public good. Its low-tech usability and capacity to function off the grid give it unparalleled resilience when digital payments are unexpectedly offline. Its status as legal tender ensures it is universally accepted, accessible to all, and is free to use for citizens, making it an important public good and public infrastructure.

The anonymizing features of cash provide a degree of privacy that is increasingly important to consumers at a time when companies can track every cashless purchase and some state actors have begun to use digital platforms to monitor their citizens.