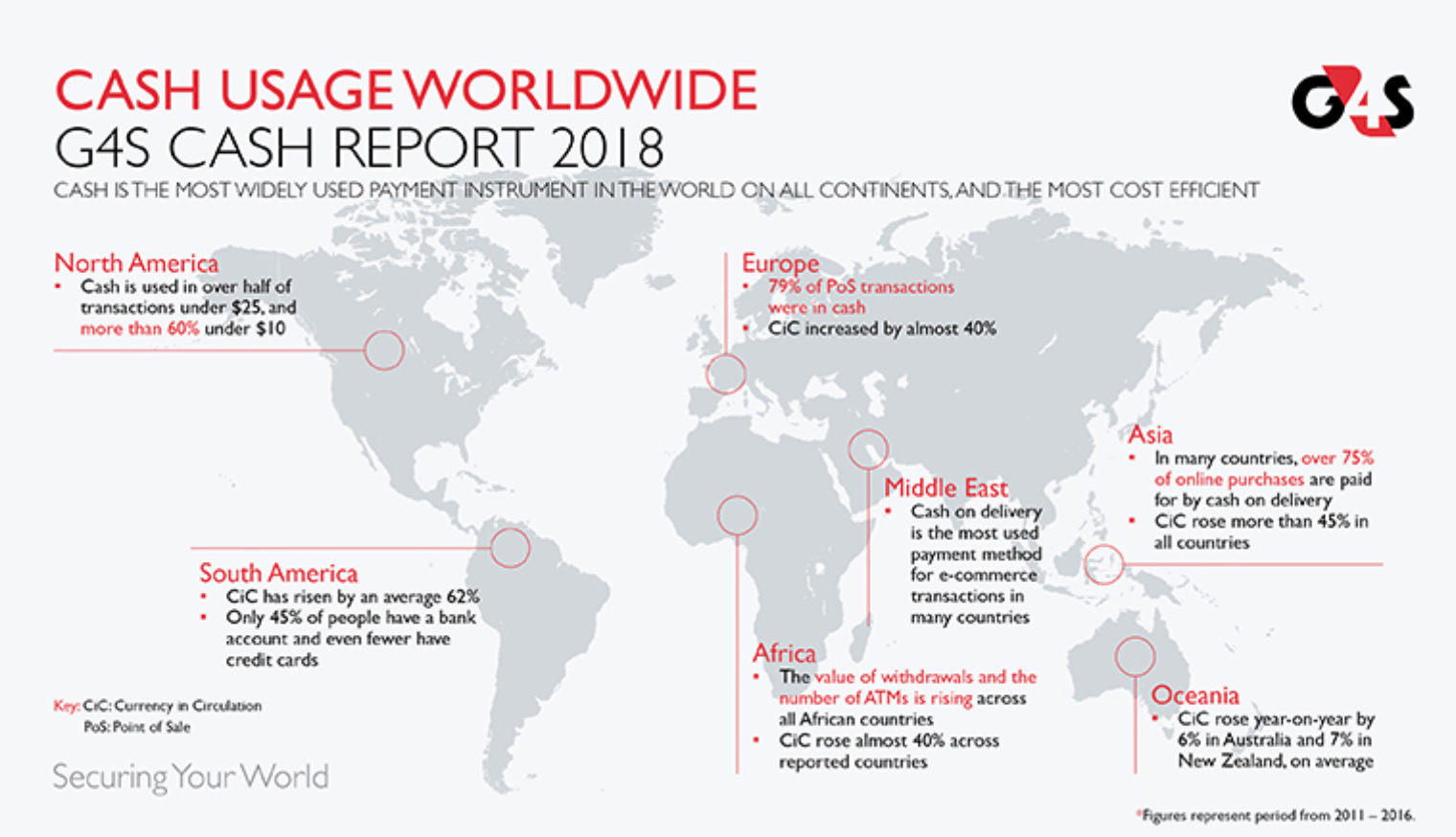

In Asia, over 75% of e-commerce transactions are paid with cash upon delivery (G4S, 2018)

The report uses payment dairy surveys from over 24 countries, offering a global view on cash use. According to the findings from the G4S report, in Asia, over 75% of e-commerce transactions happened with cash on delivery (G4S, 2018).

Based on available diary surveys, the report also finds that while non-cash payments are on the rise at a faster rate than tangible money, cash continues to be the most used payment method, globally, selected for more than 50% of payments across 75% of countries.

Simply put, the world cannot do without cash.

Critically, the global cash report concludes out that there shouldn’t be any competition between cash versus non-cash, nor should it be an either/or proposition. There is simply a need to make payments in all circumstances, and both cash and non-cash payment instruments adequately fulfill this need.

Other findings include

- In Asia, cash in circulation has risen more than 45% across all countries

- In Asia, over 75% of e-commerce transactions happened with cash on delivery

- Globally, cash in circulation relative to GDP has increased to 9.6% across all continents, up from 8.1% in 2011.

- Globally, the value of ATM withdrawals experienced a positive (average weighted) growth rate of 4.6% in 2015.

- Globally, cash is used in over 50% of transactions across 75% of all countries

Given these observations, a logical conclusion could be that cash transaction volumes on a global level seem to be increasing in absolute terms, while at the same time, electronic payment transaction volumes are increasing even 5 faster. This results in a diminished share of cash in the total payment mix. (p. 134)

The attractiveness of cash and the reason consumers often select cash as their preferred method of payment (if they have a choice in payment method in the first place), could be because cash uniquely covers many of the features that consumers most value in a payment instrument, such as 100% availability and reliability, anonymity, and direct settlement without the need for a technical infrastructure. (p. 130)

Even though cash is still paramount across Asia, growth rates for electronic payments, both in infrastructure and transaction volumes, are impressive. Card transaction volumes are soaring, as are mobile (wallet) payment solutions such as WeChat and AliPay. Asia is very diverse, with some countries depending almost solely on cash while others, like South Korea, are leading the way in becoming more and more cash independent. (p. 132)