10th IMF Financial Access Survey (FAS)

The latest FAS report from the IMF finds that mobile money payments are booming in Sub-Saharan Africa and parts of South Asia, resulting in a disruption to traditional banking and, because of an unrelenting gender gap in low to middle-income countries, a promise for regulation reforms addressing credit discrimination on the basis of sex and gender.

The database reminds policymakers of the importance of (and demand for) non-discriminatory payment forms. Of course, this doesn't mean cash is being pushed out. On the contrary, cash plays an essential role as a social equalizer. In Kenya, home of the M-Pesa, the central bank published the FinAccess Household Survey reporting despite the growth of mobile payments, cash continues to be used overwhelmingly for everyday payments and bills.

Excerpt from 2019 FAS report

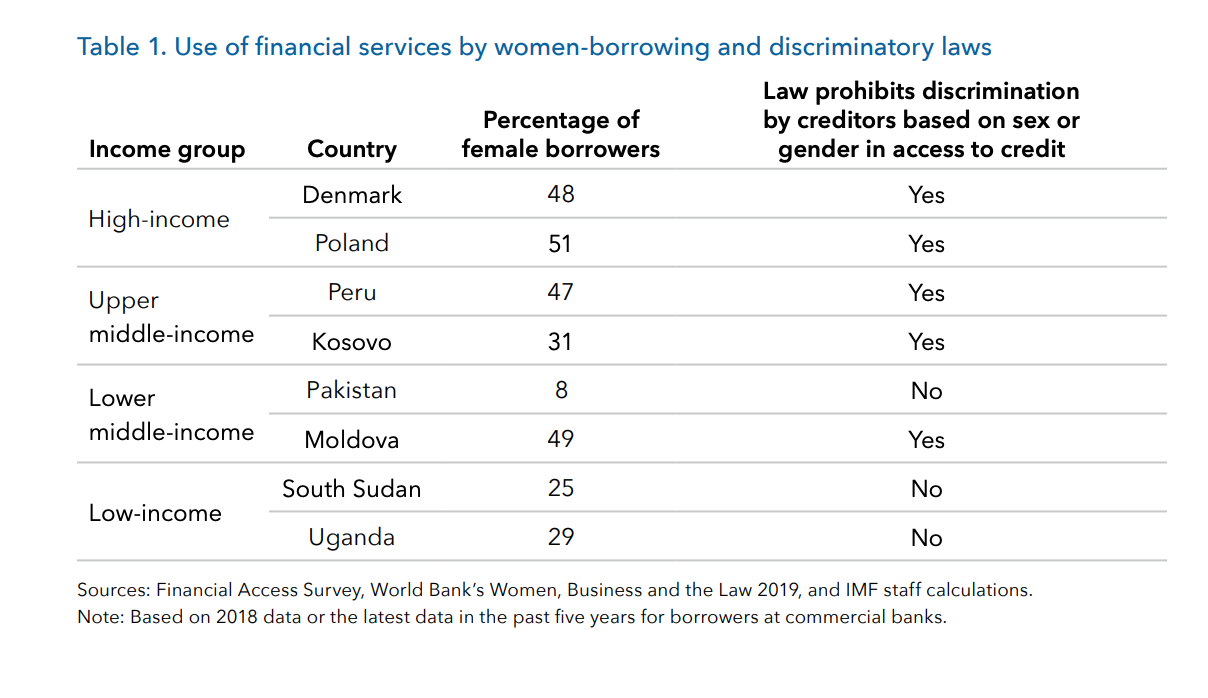

The FAS data suggests that there are major disparities in the use of financial services between men and women, especially in low- and lower middle-income countries. In countries such as Pakistan, Uganda, and South Sudan, less than 30 percent of borrowers at commercial banks are women. In contrast, the high-income countries in Europe, including Denmark and Poland fare better, with close to 50 percent of borrowers being women (Table 1).

While there are several underlying reasons for women’s exclusion from the financial system, including women’s limited labor market participation, studies suggest that discriminatory laws can be a major hindrance (World Bank 2018). FAS data for select countries in Table 1 seems broadly in line with those findings. Countries where there are laws prohibiting financial service providers from discriminating against borrowers based on gender tend to have higher shares of female borrowers.

Excerpt from the IMF press release

On September 30, 2019, the International Monetary Fund (IMF) released the results of the tenth annual Financial Access Survey (FAS). The FAS is a unique supply-side dataset that enables policymakers to measure and monitor financial inclusion and benchmark progress against peers. The dataset covers 189 jurisdictions with more than 150 indicators on financial access and use with historical data from 2004.

The 2019 FAS introduces new data series on mobile and internet banking and gender statistics for deposit-taking micro-finance institutions, given the digital transformation in finance and growing importance of micro-savings for women’s financial inclusion. The current round of FAS has also improved reporting on some existing data series. The number of countries reporting mobile money data increased from 66 last year to 71, and those reporting data disaggregated by gender increased from 35 to 47...