Cash usage increases by two thirds in the UK

Cash withdrawals in the UK have increased by two thirds following the easing of lockdown measures on 4th July 2020, which saw pubs and restaurants re-open across the nation.

The news is accompanied by findings from a spending survey which revealed “53pc of people have used cash in the last fortnight” with 8pc of people using cash for a haircut and 4pc using “coins and notes in the pub.”

The data, provided by Link, which operates Britain’s main cash machine network, states £1.5bn in cash withdrawals are occurring each week with an average withdrawal value of £77. The findings, which have been published in The Telegraph, address the “fears that coronavirus would cause an irreversible slump in cash usage”, defying those speculating that covid could lead to the demise of the legal tender in the UK.

“About 20 million cash withdrawals are now being made each week, an in-crease of 64pc compared to April."

While the re-opening of pubs and restaurants has been attributed to the increase in cash transactions, “the biggest cash users were customers in convenience shops and supermarkets” despite national supermarket chains requests for contactless or cashless payments where possible.

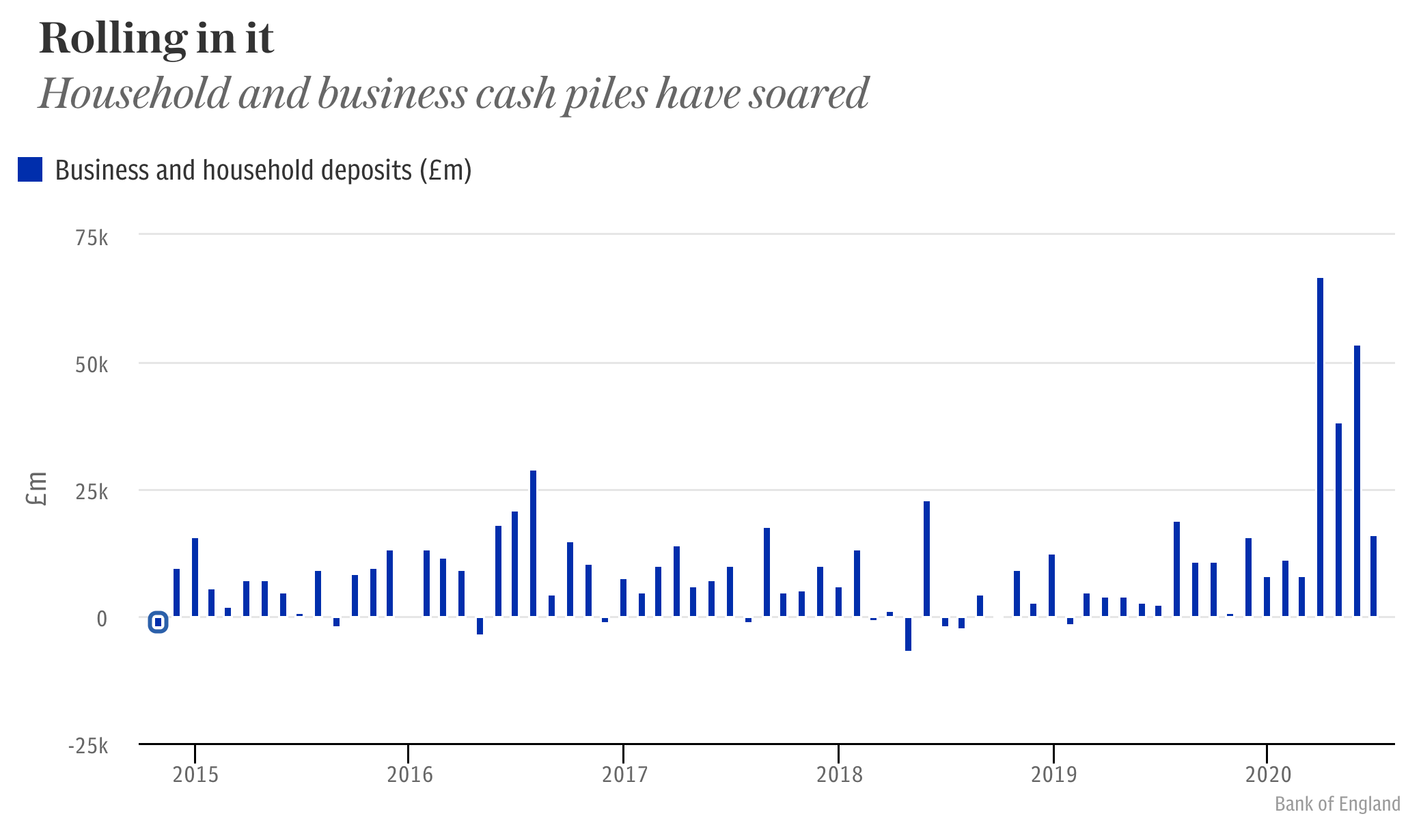

Though cash demand plummeted in the UK earlier this year following the imposed lockdown measures, figures indicate that the British public has been “piling up billions in unspent cash.” The Telegraph reported that, in June, households and businesses contributed to “the extra £175bn which has been deposited with banks – more than the cumulative total for most years.” For some, this news is unsurprising. In April this year, 14% of consumers said they were “keeping more cash at home in case of emergencies.” While the British public is only just rekindling its relationship with cash, reports of the UK’s reliance on the resilience of cash mirrors reports from Canada, Mexico, the U.S. and Europe.

Speaking to The Telegraph, Link’s chief executive officer John Howell’s echoed the demand for cash, saying “our underlying data show that cash remains popular and important.”