The 2014 Global Findex Database from the World Bank (Apr, 2015)

In 2011 the World Bank published the first Global Findex Database. In 2015, the World Bank published the second representing 2014. Now, in 2018, the World Bank has published the third, and latest report on 'comparable indicators showing how people around the world save, borrow, make payments and manage risk'.

Within the research, readers will find plenty of figures relating to cash use around the world, making the working paper useful reading for payments policy influencers worldwide.

The paper acknowledges that policymakers may make efforts to shift wages from cash to digital.

'Governments and the private sector can play a pivotal role by shifting the payment of wages and government transfers from cash into accounts.' (p. 2)

But while this could have various positive impacts on developing countries, it would also have endless challenges and dire consequences.

'...the benefits of moving cash payments into accounts are realized only if sending or receiving payments electronically is at least as easy, affordable, convenient, proximate, and secure as doing so in cash.' (p. 2)

As we saw with India's demonetization failure, there is a difference between artificially incentivizing, or rather, forcing the public to move from cash and offering additional payment alternatives. Once cash is forcefully removed from a payments landscape, a very large portion of the world's adults is excluded.

Some key statistics

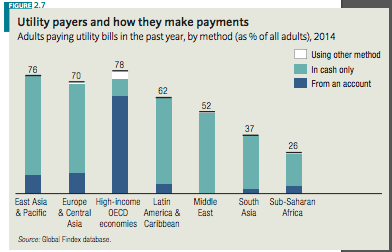

- 1.3 billion adults with an account pay utility bills in cash (p. 68)

- .5 billion people pay for school fees in cash (p. 68)

- 400 million people (over 20 percent of unbanked adults) receive wages or government transfers in cash. (p. 5)

- 130 million adults without an account receive government transfer payments only in cash. (p.31)

- 280 million adults receive private sector wages only in cash. (p.31)

Excerpts from World Bank's Global Findex working paper

In developing economies overall, 23 percent of unbanked adults—440 million people—receive payments in cash for the sale of agricultural products. Across developing regions, 36 percent of unbanked adults (125 million) receive such payments in cash in Sub-Saharan Africa, 33 percent (160 million) in East Asia and the Pacific, and 17 percent (105 million) in South Asia. (p. 5)

In developing economies more than 1.3 billion adults who have an account nevertheless use cash to pay their utility bills or school fees. Some 56 percent of account holders—1.3 billion adults—make utility payments in cash, and 24 percent—more than 500 million adults—pay school fees in cash. And 22 percent of adults with an account pay both utility bills and school fees in cash. (p. 67)

Source

Demirguc-Kunt, Asli, Leora Klapper, Dorothe Singer and Peter Van Oudheusden. 'Global Findex Database 2014: Measuring Financial Inclusion around the World'. World Bank Policy Research Working Paper 7255. Published April 2015. Last accessed April 11, 2018.

Related articles

Cash Matters Globally, 2 billion people are unbanked

There has been notable progress regarding worldwide financial inclusion, with approximately 700 million more people holding bank accounts between 2011 and 2014. But even though there were 2.5 billion unbanked adults in 2011 and 2 billion in 2014, it still means that at least 38% of the world's population relies exclusively on cash. Continue reading...