Survey on Payment Methods 2017 report from the Swiss National Bank

According to the data taken from the SNB 2017 survey on payment methods, the use of cash makes up 70% of household payments in terms of number, and 45% in terms of value.

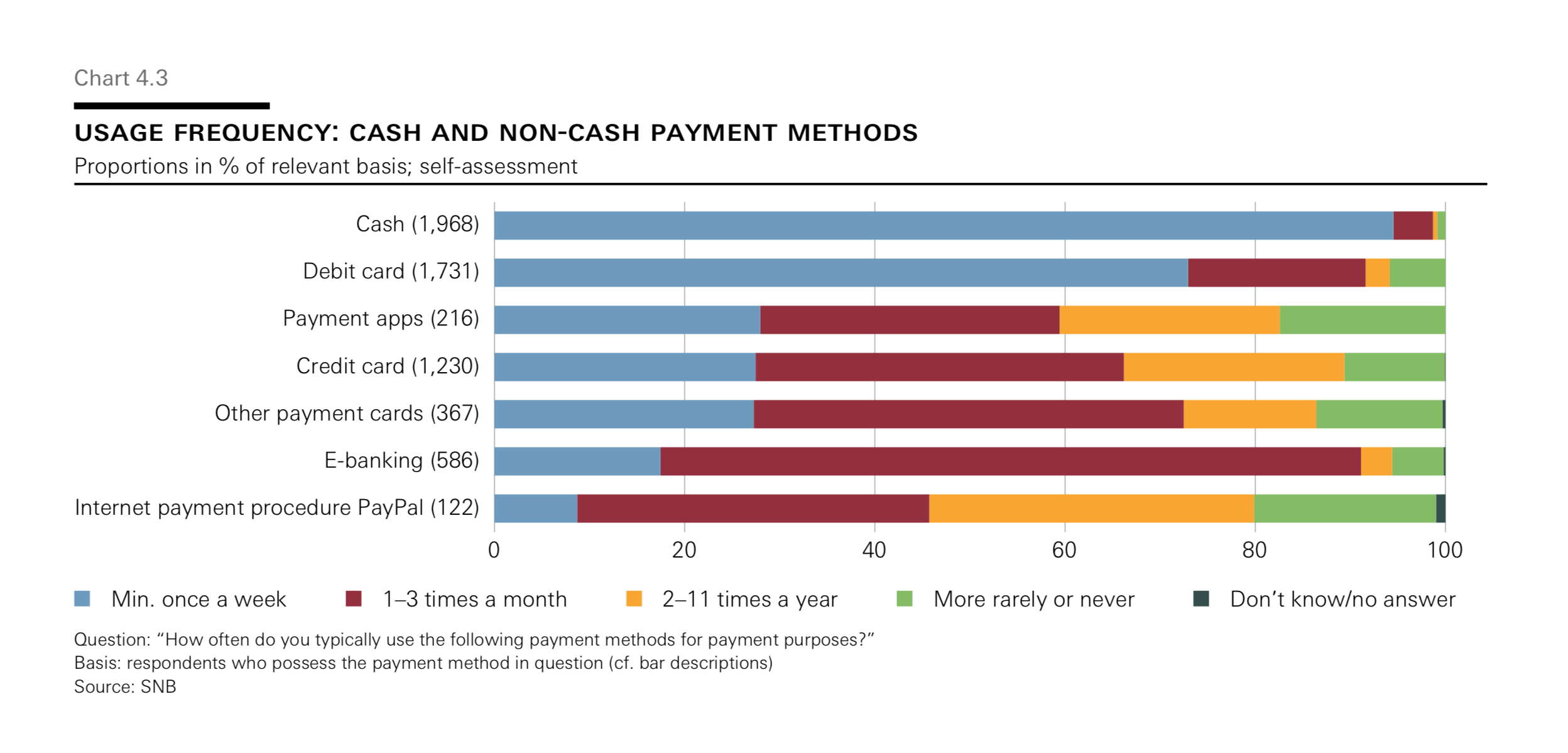

The SNB report concludes that 'the different payment methods appear to complement each other. Cash is of exceptional importance for small amounts, while debit cards are widely used for medium-sized amounts and credit cards for larger amounts'.

Key findings include

- Cash is the payment method most used by the resident population in Switzerland (70% of recorded payments), followed by the debit card (22%) and the credit card (5%).

- When measured in terms of the overall value of the payments recorded, cashless payment predominates (55%).

- Thanks to the ready availability of cash in Switzerland and the high acceptance of non-cash payment instruments, residents have freedom of choice at most places of payment.

- Overall, households appear to be very satisfiedwith the existing wide range of payment options.

'Thanks to a seamlessly functioning cashless payment system on the one hand, and an extensive network of ATMs for the withdrawal of cash on the other, Switzerland offers a supportive infrastructure that enables the population to choose their preferred payment method in any given situation.'

Excerpts from the Swiss National Bank 2017 Survey

In the autumn of 2017, the Swiss National Bank (SNB) conducted a survey on payment methods for the first time. The aim of the survey is to obtain representative information on payment behavior and the use of cash by households in Switzerland, and to ascertain the underlying motives for this behavior.

Cash is the most common method of payment for households in Switzerland. Of the payments recorded, 70% were processed with cash. When measured in terms of value, by contrast, cash accounted for just 45% of the recorded expenditure. This difference is attributable to the fact that cash is a particularly popular payment method for small amounts. That said, cash is also often used when larger sums are involved: 35% of non-recurring payments that involve amounts of more than CHF 1,000 are settled with cash.

Respondents who expect to use cash less often in future most frequently cite a social trend away from cash as the reason (cf. chart 4.18). This is followed by the assessment that the acceptance and simplicity of non-cash payment methods and procedures will increase. The fact that an exogenous factor is stressed is another indication that existing preferences for a particular payment method are very important.

At the same time, this points to a relatively high degree of satisfaction with the status quo, which is not least likely to be attributable to the fact that freedom of choice is ensured by an efficient supply of cash and a secure infrastructure for cashless payments that is only rarely subject to disruption (cf. section 4.3).

Related articles