British Cash Use Rises as Budgets Tighten

Cash use in the UK has risen for the first time in over a decade as more Brits discover physical money can help them improve control of their finances. This follows an international trend of younger generations budgeting with cash, driven by TikTok and other social media channels.

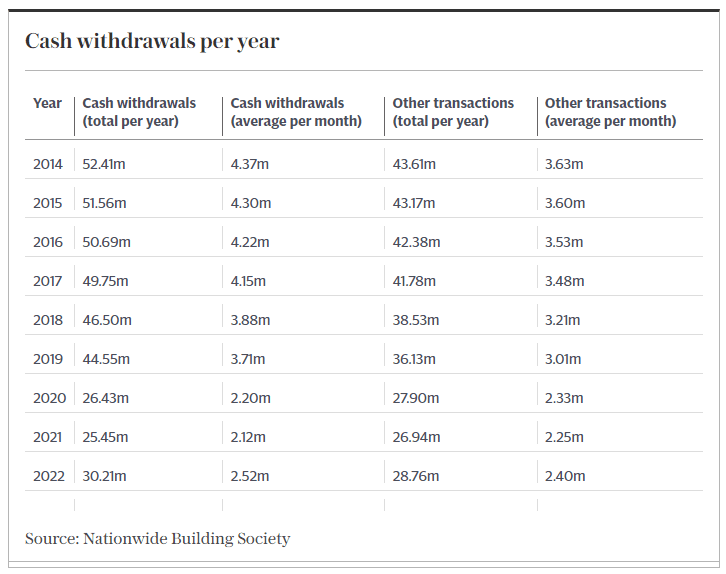

A report by The Telegraph, drawing on research from Nationwide Building Society, says cash use increased in 2022—having declined over the previous 13 years—and attributes its resurgence in popularity to ‘squeezed household budgets’ encouraging people to ‘shun bank cards and turn to physical money.’

Sarah Coles, a personal finance analyst at financial services company Hargreaves Lansdown, said more and more people are finding cash preferable to other payment options for managing their finances, pointing to social media trends encouraging people to employ cash as a ‘budgeting hack’. She notes ‘the prophesied death of cash’ has been greatly exaggerated.

An awful lot of people are completely reliant on being able to get access to notes and coins, and an increasing number are finding that it comes in handy for budgeting purposes too. Sometimes it’s easier to manage your money if you can physically see how much cash you have left.

With a total of over £30 million withdrawn in 2022, withdrawals saw a return to pre-pandemic levels after dropping sharply in the previous two years.

Nationwide reported its busiest ATMs were largely located in London, with Southall, East Ham and Upton Park all among the top five locations for withdrawals. Besides these, Ilfracombe in North Devon and Gillingham in Kent were the other sites making the most use of cash machines.

Otto Benz, Director of Payments for Nationwide, suggests the data points to the continued importance of cash and its evolving role within a landscape of payment innovation.

For the first time in years, we are seeing a natural rise in cash withdrawals as people return to using cash to help avoid getting into debt from the rising cost of living… Far from the end for cash, it shows that the future of money management is constantly evolving.