RBS, NatWest & Ulster Bank customers turn to cash after network crash

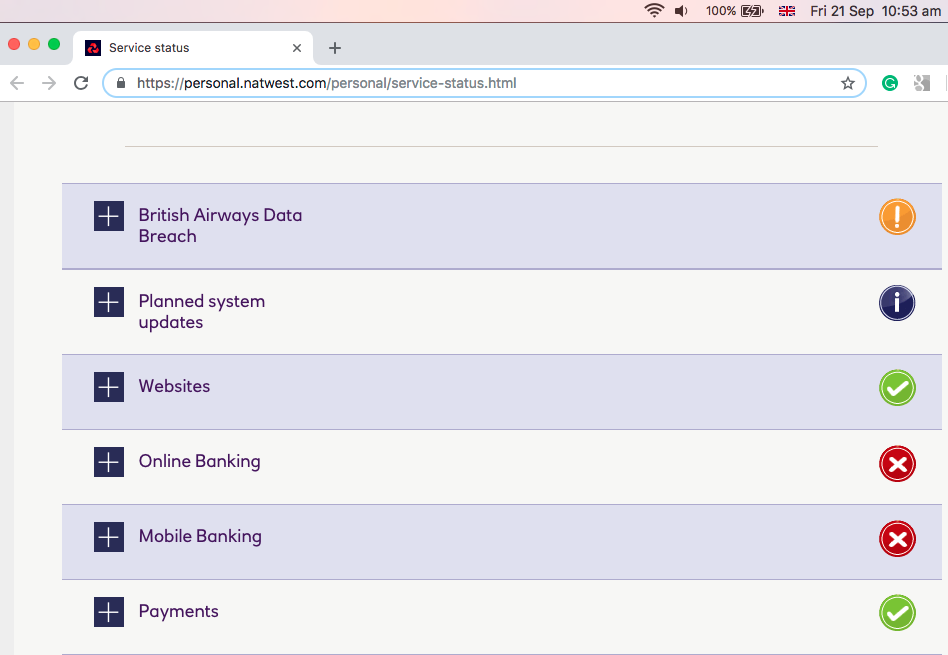

Throughout the morning of September 21st, 2018, NatWest customers faced a frantic Friday as the Royal Bank of Scotland, NatWest and Ulster Bank experienced a technological glitch that left their customers unable to access their mobile or online banking services. So much for TGIF...

The timing of the crash was, to say the least, panic-inducing. Most NatWest bank branches are closed on Saturdays and Sundays, meaning millions of their customers had to decide on the spot whether to miss work (with little notice) and rush to their bank branches to settle bills before the weekend.

Not knowing when the problem would be resolved, the public turned to cash to ensure they are not left financially vulnerable over the weekend. It is also payday for millions, a crucial time for electronic banking. Understandably, professionals expect their salary to be paid on time, planning to pay their end-of-the-month bills, travel expenses and even mortgages over the weekend.

While services resumed 6 long hours later, this latest electronic banking glitch serves as a stark reminder of the value of cash.

It's a positive thing to have choices in the payments landscape: mobile, online, card and even crypto. But since not one of these options is immune to unexpected technological hiccups, it is essential that we hang on to reliable, tangible and crash-free cash.

The far-reaching frustration is momentous within the cash debate as the public is once again forced to reconsider what it would mean to rely entirely on the fragile network of electronic banking in a fully cashless society.

'We are aware of the problems our customers are having and apologise, we will provide more information as soon as we have it.'

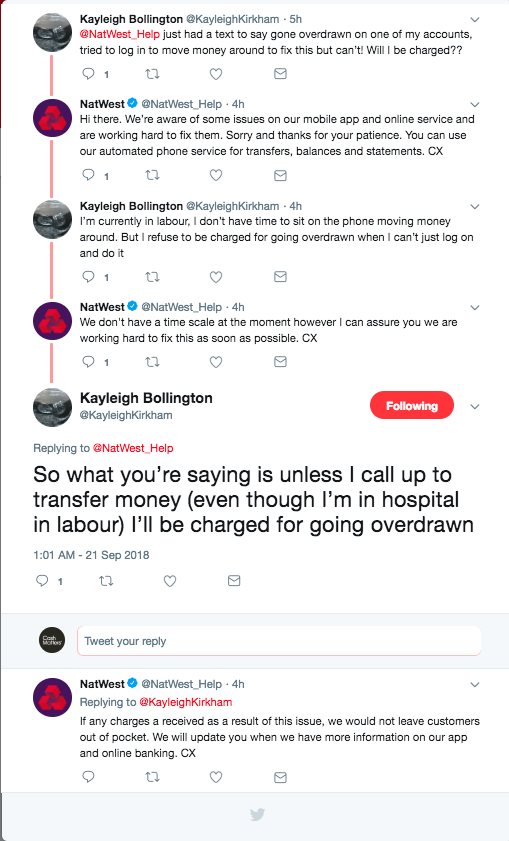

NatWest was flooded with perfectly valid complaints via Twitter but 'Sorry and thanks for your patience' responses have done little to calm the millions of inconvenienced customers.

One NatWest account holder was mid-labor when the glitch happened. If having a baby wasn't enough of a strain, the added stress of an uncooperative banking app, looming overdraft fees, and unhelpful responses is simply cruel.

Other customers were mid-travel when they realized they couldn't pay for their trains or buses. Some reported having to take pricey taxis, praying to NatWest's Twitter response team that they would be compensated.

While NatWest reminded their customer of their telephone banking options, one Twitter user pointed out that calling requires waiting on hold for a long time, adding that perhaps he should bill the bank his hourly rate for the time spent trying to get connected.

Eventually, the connection was reestablished but the ripple of inconvenience is far from over as customers will spend the weekend figuring out how to reimburse the work, friend or family that had to come to their rescue when they unexpectedly found themselves cardless.

In light of the recent British Airways hacker attack, the Cardnet glitch and the Visa crash, the violent surge in cybersecurity issues plaguing the past few months, consumers must, for their own sake, reflect on their relationship with payment forms.

While diversity within the payments landscape protects against adversity, cash continues to hold its crown as the most trustworthy option for a reason.

Undeniably, cash is the number one contingency plan when it comes to payments.

"We are still working through what the issue is - absolute apologies to customers…"

Related Articles

BBC News NatWest, RBS and Ulster Bank hit by online banking glitch

Customers of RBS, NatWest and Ulster Bank are currently unable to access their accounts through the banking group's online and app platforms. Since around 05:00 on Friday morning, account holders have been reporting problems with the services. Many have taken to social media today to complain in an echo of problems at rival Barclays yesterday.

Sky News RBS group online and mobile banking services down

RBS customers across the banking group's three outlets have been left locked out their accounts as they tried to access online banking or mobile apps. The group has apologized as customers at its Royal Bank of Scotland, Natwest and Ulster Banks were left locked out their accounts when they tried to access its online banking or mobile app.

Daily Star NatWest online DOWN: Mobile banking not working leaving millions stranded

Millions of Brits have woken up this morning unable to access their cash on NatWest and Royal Bank of Scotland. The banks confirmed this morning they were having problems with their online and phone service. Six million people using their online banking have been left in the lurch by the issues...

Express NatWest online banking DOWN: Problems on NatWest mobile leave customers locked out

Millions of mobile and online banking customers have been urged to use telephone banking instead should they need to use the service urgently after NatWest and RBS mobile apps went down.

Cash Matters 380,000 card transactions intercepted in British Airways hacking attack

The British Airways website and app were the host of a recent hacker attack which affected hundreds of thousands of BA customers in under two weeks with 380,000 transactions intercepted.

Cash Matters Visa crashes and everyone turns to cash

Card users across Europe were failed by Visa on Friday, June 1st, 2018 when the card giant's network crashed unexpectedly. One Twitter user described the chaos as a deleted scene from Lord of the Rings.

Cash Matters Cardnet, Lloyds Bank & Visa fail customers as network glitch charges UK card users twice

One glitch and thousands of cardholders across the UK were wrongly charged twice for card payments made on Wednesday 29th August 2018. To make matters worse, receipts did not reflect the double-charge, forcing countless of unsuspecting customers into their overdraft...

Cash Matters Cashless warnings still echo after Zimbabwe's EcoCash crash

Zimbabwe's infamous money problems got a whole lot worse last week when EcoCash, the nation's 'mobile money solution' failed for two days, distressing merchants and consumers alike. One glitch and an entire region are unable to buy water, food or medical supplies for days. Therein lies the danger in an individual or a country relying entirely on non-cash payments.