'Cash is clearly holding its ground in the U.K.', finds new PYMNTS report

Even in the face of the digital age, cash continues to be king in the fifth largest economy in the world. The new PYMNTS Global Cash Index™ United Kingdom Analysis, a Cardtronics collaboration, reveals that 'overall cash usage is growing'.

Cash is British consumers' preferred budgeting tool especially for the average spender who appreciate how it comes with no fees and is the easiest to access. A featured story attached to the report titled "In the UK, cash and contactless are vying to stay on top" reports that 'as of 2016, total banknotes in circulation grew by 10 percent to reach £70 billion — the fastest growth in a decade, according to the Bank of England' (p.12 PYMNTS, Nov 2017).

Excerpt from PYMNTS Global Cash Index™ article

...According to research inside, [cash's] grip on the crown is only getting stronger. Total banknotes in circulation surged in 2016, growing by 10 percent to a total of $70 billion — the fastest growth in a decade, according to the Bank of England (BoE). Meanwhile, cash accounts for more than 42 percent of retail purchases in the U.K.

Key findings include

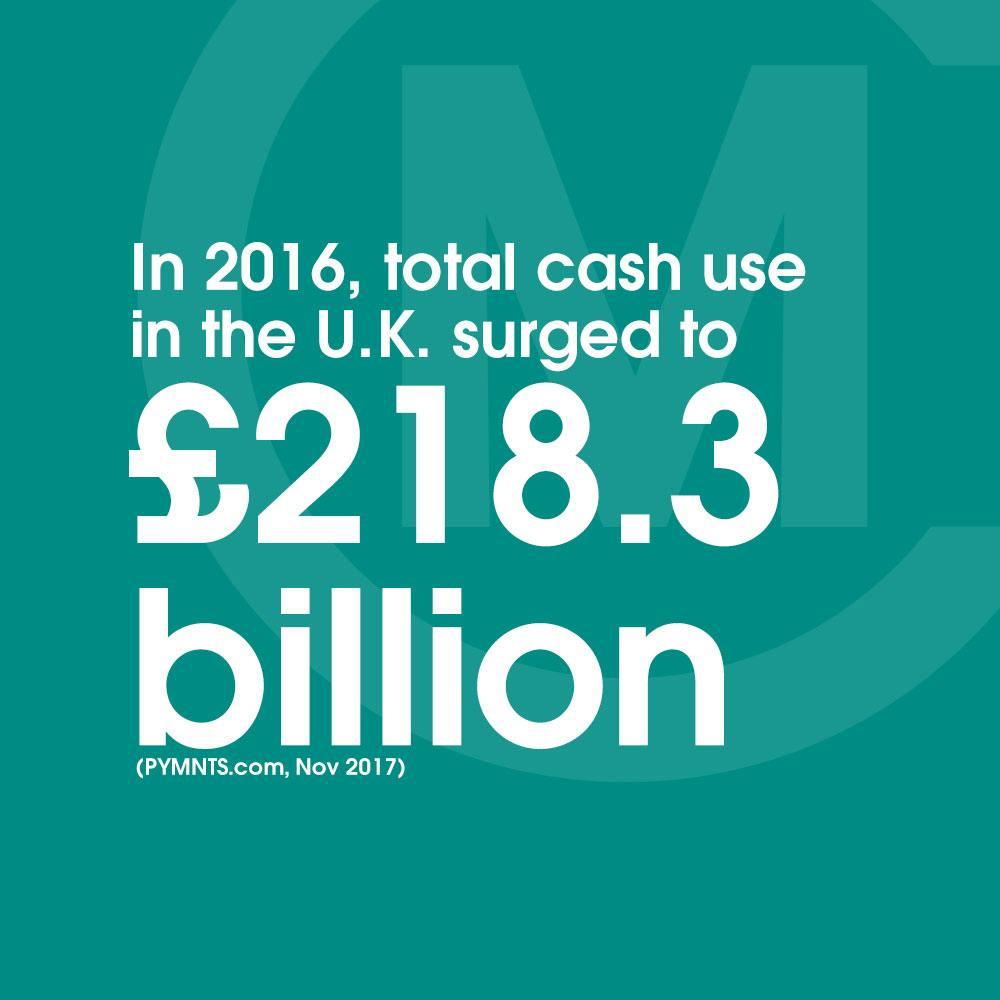

- Total cash use in the U.K. surged to £218.3 billion in 2016 representing 11.3 percent of the GDP.

- With banks shuttering, consumers are increasingly relying on ATMs for accessing cash. The U.K. has 108 ATMs and 30 bank branches per 100,000 people.

- Cash usage may be growing, but overall share of cash is declining. Between 2010 and 2016, cash share declined by roughly 4 percent even as usage increased.

Excerpt from PYMNTS Global Cash Index™ report introduction page 2

The United Kingdom’s £350 billion-plus retail industry is undergoing a massive facelift. From artificial intelligence (AI)-enabled bots on merchant websites to experience-driven stores focusing less on inventory, retail shopping in the U.K. is changing fast — much like it is in the U.S...

In September 2017, the Bank of England (BoE) issued a stern warning saying the rise of consumer debt could cost banks £30 billion in losses on their credit cards, personal loans and car finance offerings if unemployment rates and interest rates were to rise sharply. Following the BoE’s warning, U.K. banks are now clamping down on offering credit cards — the biggest squeeze on credit offerings since the 2008 recession.

Whether a crackdown on credit offerings will influence use of cash remains to be seen, but the overall volume of cash in circulation is increasing with economic growth.

“At the Bank of England, we see that there’s strong demand for cash and expect that to go into the future,”

Excerpt from PYMNTS Global Cash Index™ page 7

Overall cash usage is growing, but cash’s share is declining. From 2010 to 2016, it declined by 0.46 percent per year and is expected to decline by 0.2 percent per year between 2016 and 2021.

Evolution of cash usage is dependent on a host of macroeconomic indicators, including growth of GDP, inflation and interest rates. Other influencing factors include exchange rates, international tourism, changing demographics and geopolitical developments such as Brexit or governmental changes.

Factors contributing to decline in cash’s share in the U.K. include innovations in the mobile payments space, which have a relatively higher adoption rate among younger consumers.

Click here to download PYMNTS Global Cash Index™ U.K. Analysis

Source

"Global Cash Index™ U.K. Analysis". PYMNTS and Cardtronics. Electronically published on November 29, 2017. Accessed 2 December 2017.

About the Index

The PYMNTS.com Global Cash Index™, a Cardtronics collaboration, focuses on the use of cash for making payments and as a payment method that equally plays a role with cards, checks, direct debit and other methods of settling up between consumers and businesses. Unlike most reported estimates of cash, our proprietary data analysis focuses on the use of cash for making payments rather than hoarding.